Nutmeg vs Hargreaves Lansdown: Which is best?

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

I get asked all the time whether Nutmeg or Hargreaves Lansdown is better and the truth is that they’re very different products.

While I think they’re both suitable for those new to investing, they come at it from a very different approach.

I’ve personally decided to go with Hargreaves Lansdown after experimenting with both, but that doesn’t mean it’ll be the right decision for you.

So here I’ll explain why Hargreaves Lansdown won it for me in the battle of investment platforms, Nutmeg vs Hargreaves Lansdown edition.

Nutmeg vs Hargreaves Lansdown: an overview

Nutmeg and Hargreaves Lansdown are both considered big players in investing these days but they have very different backgrounds

Nutmeg, the newcomer

As an investment platform, Nutmeg is a relative newcomer. It was founded in April 2011 by Nick Hungerford, and was acquired by JP Morgan in June 2021.

What made it really different was the fact that it was one of the earliest robo-advisor platforms to launch.

This meant it leveraged a mix of technology, algorithms and investing experts to create ready-made portfolios that you could more or less “buy off the shelf” – the finance equivalent of ready to wear.

While it’s one of the most popular platforms in the robo-advisor category, the number of investment products it offers is still quite limited.

Read more: Is Nutmeg the investment platform for you?

Hargreaves Lansdown, the stalwart

Hargreaves Lansdown has a much longer history.

It was founded by Peter Hargreaves and Stephen Lansdown in 1981 and later became a publicly traded company.

Today it’s one of the most well regarded investment platforms, with a range of savings and investment products.

In August 2024, a takeover of the firm by a private equity consortium was agreed.

Once the deal goes through, the company will be delisted from the London Stock Exchange and return to being one that’s privately owned.

The implications of that remain to be seen though that shouldn’t affect the day-to-day operations of the business.

Read more: Hargreaves Lansdown review: Investing as a beginner

Product range comparison

When it comes to product range, Hargreaves Lansdown wins hands down.

Nutmeg’s product range

Nutmeg has a limited product range, with five basic products:

- Stocks and shares ISA

- Stocks and shares Lifetime ISA

- Stocks and shares junior ISA

- General investment account

- Personal pension

With any of these products, you can choose from one of five investment styles and define your attitude to risk, which helps Nutmeg put together your portfolio.

Hargreaves Lansdown’s product range

As a financial services company, Hargreaves Lansdown* has a much more extensive product range.

For ISAs, you can choose from:

- Stocks and shares ISA

- Lifetime ISA

- Cash ISA

- Junior stocks and shares ISA

On pensions, they offer:

- SIPP (Self-Invested Personal Pension)

- Junior SIPP

- Pension drawdown

- Annuities

- Uncrystallised funds pension lump sum (UFPLS)

On top of the core product range they also have:

- Fund and Share Account, for investing outside of a tax free wrapper

- Active Savings Account, a sort of savings account brokerage

- Foreign Currency Service, to facilitate currency transfers abroad

Basically, you can use them for any sort of long term wealth building.

Investment options

As Nutmeg and Hargreaves Lansdown both offer investment products through general investment accounts (not tax free), ISAs, and pensions, this is the easiest way to compare the two.

Investing with Nutmeg

Nutmeg only offers products where they do the investing for you – so no DIY portfolios or SIPPs here.

The minimum amount you need to open an account is £500.

Once you’ve picked a product, they will put a portfolio together for you based on the investing approach you’ve chosen, your risk appetite and when you plan to cash out.

Nutmeg does this through a questionnaire.

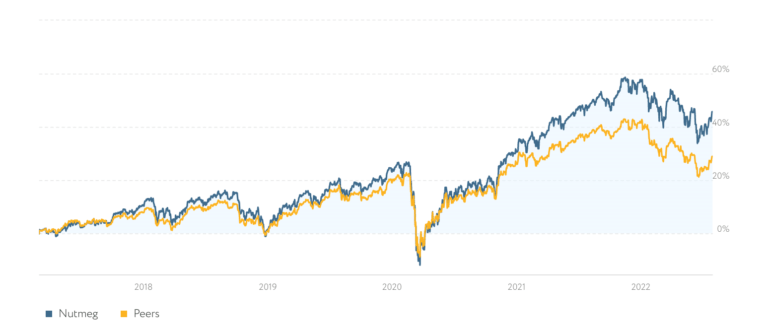

Some of the portfolios they offer are more actively managed than others, which will affect the performance and the fees.

In my experience, the returns on the more actively managed portfolios were pretty decent.

Once a year, Nutmeg will get you to retake the questionnaire, which will assess whether your outlook has changed.

Based on this, Nutmeg will then suggest changes to your portfolio, which you can ignore if you want to.

It’s worth noting that Nutmeg will only deal in exchange traded funds (ETFs), which it defines as “liquid, low cost, flexible and transparent funds that track an index”.

On a lower risk portfolio, some of your money may also be held as cash.

I liked Nutmeg’s set it and forget it approach, which made investing much less consuming for me – it was one reason why I went with them first.

Investing with Hargreaves Lansdown

Hargreaves Lansdown offers “ready made” portfolios as well as DIY options.

You’ll need a minimum of £100 to open an ISA, and just £1 for a Fund and Share account (not tax free) – though you’ll need at least £100 to buy funds.

Hargreaves Lansdown’s ready made portfolios are actually just different funds actively managed by their in-house experts.

It means they’re a bit more expensive than other funds available on the platform, and may not necessarily align with your investment objectives.

Unlike Nutmeg, Hargreaves Lansdown’s platform will let you buy and sell shares, funds, ETFs, investment trusts, and gilts and bonds, which potentially means greater diversity in your portfolio.

The reason why I went with Hargreaves Lansdown was because they offered DIY portfolios, and I wanted to experiment with that.

I focus on funds only for my portfolio because they’re already pretty diversified, are low cost and Hargreaves Lansdown doesn’t charge me extra to trade these.

Plus, many are index tracked, which means they don’t require a lot of time to manage.

It requires a bit more research than Nutmeg’s offering, but can potentially be a bit more rewarding.

Once a year, Hargreaves Lansdown will send you an analysis of your portfolio, which will give you a breakdown of the industries and countries you’re invested in.

If you want to change your portfolio mix, this is a good time to reassess.

Fees comparison

Comparing fees for Nutmeg and Hargreaves Lansdown is tricky because there are so many variables depending on the product you choose.

Because of this, the numbers I give below should be taken as a guide only.

For a £10,000 investment in a stocks and shares ISA, you would pay Nutmeg a minimum of £68 a year in fees.

This is made up of £45 in management fees to Nutmeg for its Fixed Allocation product (the cheapest option), £20 in fund costs (money charged by the ETFs) and £3 in market spread (cost of dealing funds).

For Hargreaves Lansdown, assuming you’re only holding funds and not other investments, fees start from just £45 a year*.

On top of this you’ll pay fund costs based on what you pick for your portfolio, although there’s no market spread.

Some funds charge as little as 0.04% in fees, which translates to £4 a year. Total bargain.

Hargreaves Lansdown obviously works out to be quite a bit cheaper in terms of fees for funds but it’s worth noting that if you trade shares or other products, the fees would be higher.

User friendliness

There are much cheaper investment platforms than Nutmeg and Hargreaves Lansdown but two things drew me to them.

The first is that they both have great apps and intuitive websites that make it easy to manage your money.

Managing your money can be stressful enough, there’s no sense in adding to it by using a website with tiny text or code that breaks the page if you’re using the wrong browser.

The second thing is that they’re both easy to use for novice investors.

Nutmeg offers a bit more hand holding.

Their investment literature is easy to read and mostly easy to understand, and you’re guided to your ideal portfolio with a questionnaire that you revisit each year.

Hargreaves Lansdown’s offering requires a bit more work (lots of reading basically) but it’s certainly not too onerous to bother with.

You could also cheat a bit by starting with the Wealth Shortlist*, a list of funds selected by Hargreaves Lansdown’s in-house experts.

And if you really want a shortcut, Hargreaves Lansdown also offers tailored investment advice*, with a fee based on the size of your portfolio.

Both companies also send out regular updates on the state of the economy to help you understand how your portfolio is performing in context.

Customer reviews

I’ve reviewed both Nutmeg and Hargreaves Lansdown for Money Talk and clearly the latter won because that’s where my money ended up.

But don’t just take my word for it.

Trustpilot has scored Nutmeg 4.1 based on 2,041 reviews, while Hargreaves Lansdown scored 4.2 based on 11,126 reviews.

Remember though, investing is an incredibly personal thing. You need to do your own research to decide on the best platform and portfolio for your situation.

And of course, you need to understand the risks – that you might lose it all.

Nutmeg vs Hargreaves Lansdown: my verdict

As I said at the beginning, Nutmeg and Hargreaves Lansdown offer two very different products.

Nutmeg is geared towards those who don’t want to self-manage and are happy to pay a bit more for the service.

Meanwhile, Hargreaves Lansdown will suit beginners who are happy to do a bit more work all the way up to someone who considers themselves an expert.

Depending on what you’re looking for, both can work equally well – although Hargreaves Lansdown does win on the fees front and every penny counts when you’re growing wealth.

Pin this for later