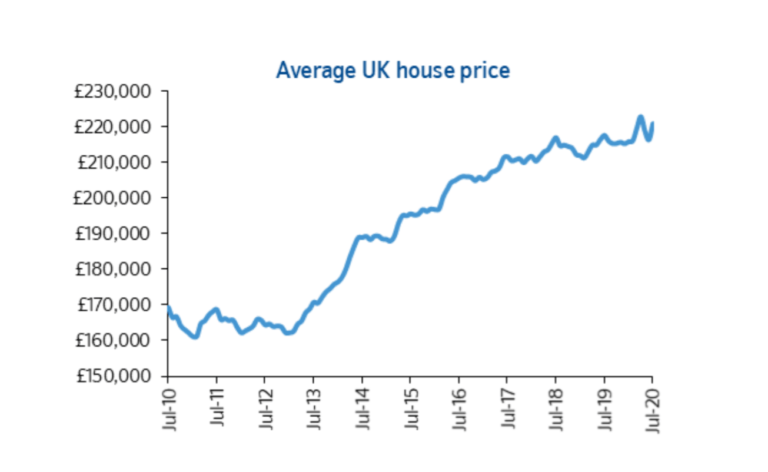

UK house prices are buoyed by stamp duty holiday

Long time readers will know that I love following property prices – not that I have an investment property on the go, or are planning to buy or sell in the near future.

But it was interesting to read in the latest Nationwide House Price Index that property prices dipped 0.2% month-on-month between February and March.

The stamp duty holiday was originally meant to end in March, and it’s clear that this deadline was beginning to impact house prices, which have held up surprisingly well so far because of these extra support measures.

Now a last-minute extension in the budget – after the Treasury already said it wouldn’t be extended – has buoyed the market once again.

Previously I would have predicted that the property market will dip when the stamp duty holiday ends later this year, but I would be doing so with far less certainly now.

As we’ve seen with the multiple extensions to the furlough scheme, and a number of other policy decisions, the government doesn’t have any qualms about a last minute U-turn. So it’s impossible to know whether we’ll see another extension later this year depending on the state of the economy.

The inflationary effect is clear though, and I find this particularly troubling.

I don’t think the policy will benefit people, especially first time buyers, in the long run. And as a buyer, I’d be scrutinising listed prices for value for money, especially in the new build sector, until the stamp duty holiday ends.

What do you think? Should the stamp duty holiday have ended last month? Should the original abrupt ending be tempered with a gradual tapering so people could finish their deals without rushing? Or is this latest extension a good thing?