House prices fell but it’s not clear by how much

You’ve probably spotted multiple headlines in the news this week on falling house prices, with vastly different estimates.

It’s no surprise. Social distancing and lockdown measures have hampered house sales in the last couple of months, and the economic uncertainty hasn’t helped.

The data from earlier in the week came from Nationwide’s latest House Price Index, which says that house prices in the UK fell by 1.7% during the month of May.

The average house price is now £218,902, according to Nationwide, down from £222,915 in April. The building society’s chief economist Robert Gardner adds that “this is the largest monthly fall since February 2009”.

In contrast, Halifax’s latest House Price Index, arriving later in the week, looks a bit sunnier.

Halifax says the UK average house price is currently £237,808 – and this is down just 0.2% compared to April.

What’s going on here?

The two indexes are compiled using different data sets.

Nationwide uses “lending data for properties at the post survey approval stage”. As it predominantly lends to homeowners in the South East, it has adjusted the results to mitigate any biases.

The Halifax index is compiled by a company called IHS Markit, which uses data from the Lloyds Banking Group (including Halifax).

While both track similar trends over time, because of the different demographic of homes included in the data sets, the exact figures are different.

May is the third month in a row that house prices have fallen according to the Halifax index and the first time it’s fallen in the Nationwide index.

Both are tentatively optimistic about government support for businesses, which they believe will positively impact house prices in the long run.

What it means for you…

All the indicators show house prices will continue to fall.

By how much and for how long, both indexes agree, will largely depend on how well and how quickly the economy recovers after coronavirus.

So whether you’re buying or selling, it’s all a matter of timing – unless it’s a necessity.

For sellers, staying put is the best option for the time being. Unless you’re sure you can make a quick sale before the market’s dipped too far.

And if you’re buying, wait and see what happens next.

Personally, I’d wait until two or three months after the furlough scheme ends in October. At that point, we’ll have a clearer picture of how much damage coronavirus has done to the economy.

The lockdown has longer term implications on the types of homes that may be popular in future too.

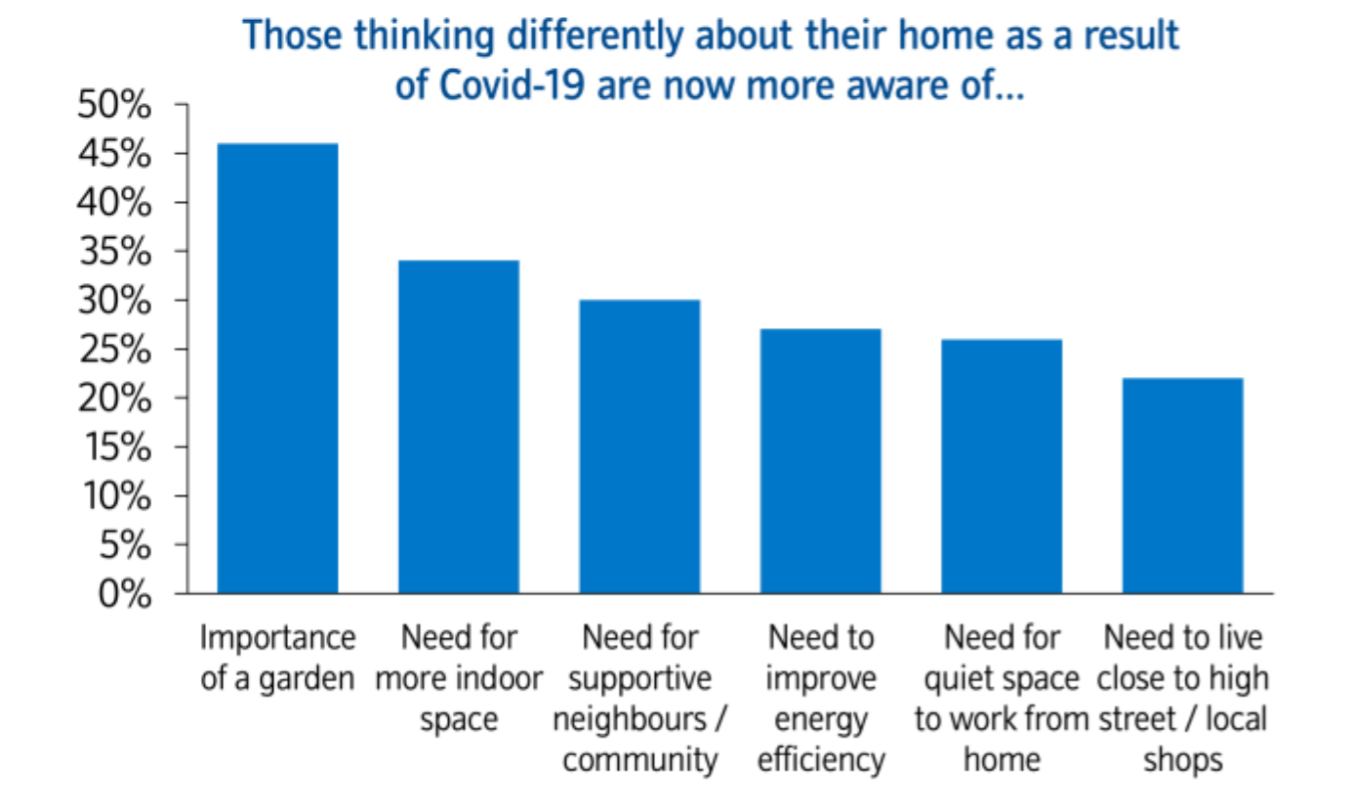

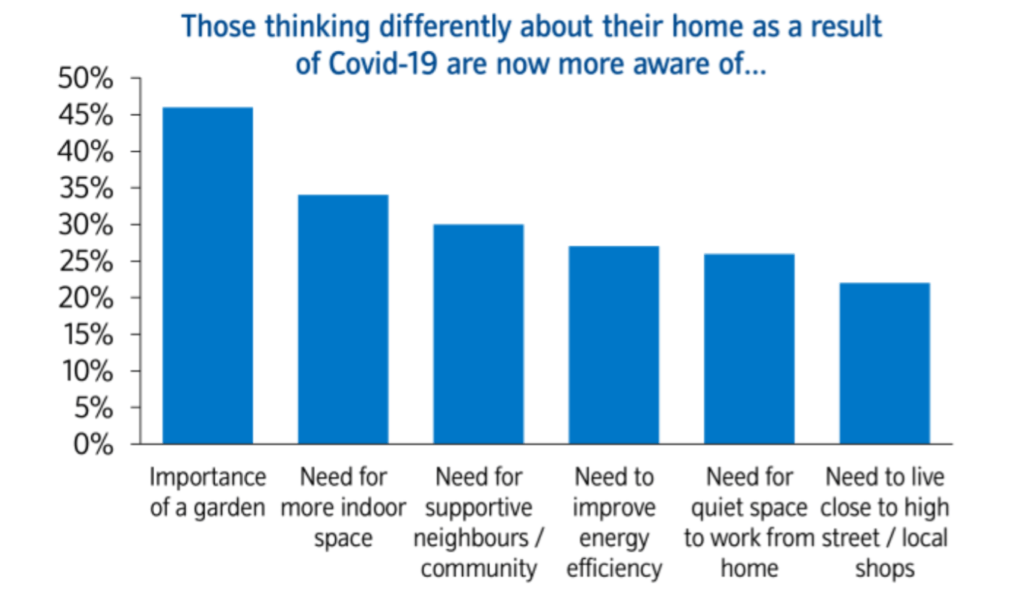

According to a recent Nationwide survey, 15% of people are thinking about moving and 34% of people said they thought differently of their home as a result of the lockdown.

When the housing market starts in earnest, I expect we’ll see a premium on homes with gardens or near green spaces. And inner city new-builds, with their economically proportioned rooms, will finally lose their appeal.

Of course, the biggest facilitators of this would be a buoyant jobs market and greater possibility of remote working.