Is now a good time to fix your mortgage?

If you’re currently on a tracker mortgage, or are coming to the end of a fixed rate mortgage, now may be the time to consider a new fixed rate mortgage.

There are two reasons for this.

Great low interest rate deals

The first is the availability of really good mortgage deals for those remortgaging.

Hinckley & Rugby Building Society led the way in April this year when they launched a mortgage deal with an interest rate that’s fixed at 0.99% for two years – the first time any lender has gone below 1% in a year.

Sub-1% mortgages are fairly rare anyway, so it was pretty big news in the mortgage world.

But since then, several major high street banks have entered the sub-1% market, including TSB, Nationwide and HSBC.

Most of the deals are for a two-year fixed mortgage with a minimum 60% loan to value (LTV) ratio, which means your mortgage can’t be more than 60% of the value of your home. There’s also a fixed fee to pay on top of that.

Inflation is rising

The second reason, and why now is a particularly good time to fix your mortgage, is that inflation is going up by leaps and bounds and interest rates may soon go up in response to that.

Every time lockdown has eased in this pandemic, inflation has gone up as the usual level of spending returned.

But this year, inflation has gone up significantly more compared to last year.

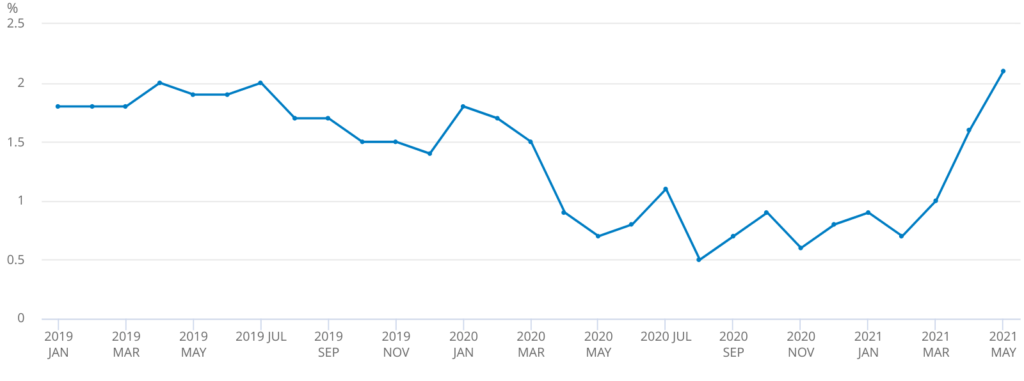

Based on the Consumer Prices Index including owner occupiers’ housing costs (CPIH) measure, inflation was a modest 0.9% in January, 0.7% in February and 1% in March.

But by April, it had leapt to 1.6% and for May it was 2.1% – above the expectations of some economists.

Clothing, motor fuel, recreational goods (particularly games and recording media), and meals and drinks out have all significantly contributed to this latest rise.

Although these figures look alarming, it’s worth bearing in mind that they reveal the increase in prices compared to the same time last year – and April and May 2020 were both lockdown months with very little economic activity.

Inflation month on month has gone up, though.

While consumers are facing the very real rise in the cost of living, the Bank of England (BoE) will be thinking about their inflation target of 2%.

One of the ways that the BoE manages inflation is to change the Bank Rate – raising it when inflation is too high (to encourage saving) and lowering it when it’s too low (to encourage spending).

The next Bank Rate announcement is on 24 June.

The BoE may well hold this at 0.1% again to see whether inflation is settling but if it continues to spike in June, Bank Rate will be adjusted accordingly.

And interest rates, which are pegged on the Bank Rate, will shift as well.

Things to bear in mind

Before you fix your mortgage, there are a couple of things to bear in mind.

First, some of the super low interest rates mortgages come with significant fees and if you only fix the rate for a short period of time, you might not save as much money as you think, if at all.

So it’s worth comparing all the deals available instead of just the ones with the lowest interest rates.

Going to a whole-of-market mortgage broker might also help you to access deals that aren’t open to the general public.

Second, if you’re in the middle of a fixed rate mortgage, it’s probably not worth switching as these usually come with an early exit fee, which might end up costing you more.

If you’ve moved onto the lender’s Standard Variable Rate (SVR), which is always higher than the introductory rate, then you’re free to move to another provider.

The same might be true if you’re near the end of your fixed rate mortgage – you’ll need to check the small print on your mortgage for this.