Job cuts are steep and there’s more to come

14,658.

That’s the number of job cuts announced this week by household name companies across the UK, including the BBC, Upper Crust, easyJet, and the Royal Mail.

It’s actually a conservative estimate as some businesses haven’t confirmed the exact numbers yet.

And, of course, that number doesn’t include the hundreds of thousands of jobs that might be affected at smaller businesses across the country.

So just how bad is it?

Two weeks ago, I wrote about how the employment market was in a state of flux.

It was hard to get a clear picture then because there were still many Covid restrictions in place, but the early indicators pointed towards opposite directions.

The Office for National Statistics’s (ONS) June 2020 Labour Market Overview said that in May, “the number of employees in the UK on payrolls is down over 600,000 compared with March 2020.”

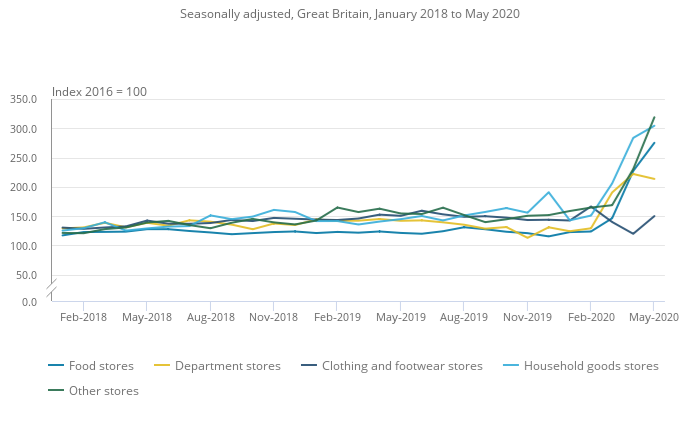

The ONS also said that with easing restrictions, there was an uptick on the number of jobs being advertised in retail. This was a positive sign.

But now, in this week alone, we have very loud headlines telling us that tens of thousands of jobs will be lost.

When you look at where the job cuts are coming from, a pattern begins to emerge. There are, broadly speaking, three types of job losses.

The first is from companies going bust. Most of these have been hospitality and retail businesses – not surprising given how heavily they were impacted by the coronavirus lockdown.

In the case of the latter, the dramatic shift from offline to online shopping during the lockdown will also have played a big part.

The second type of job cuts is reactionary. The effects of the pandemic is beginning to bite and the cuts are a reflection of that – for example, in the case of travel firms.

Finally, there are the belt tightening cuts. For some cautious business owners it will be about cutting back “just in case”. For others, sadly, it will be about creating bigger margins to please shareholders.

These “trim the fat” cuts are less predictable. And, because they depend on the confidence in the state of the economy, they generally take longer to recover.

In any case, what is clear is that there will be more cuts to come.

So many job cuts came this week because the furlough scheme is tapering off at the end of July and many firms have a 30-day consultation period. We’ll see more this month, and a flurry from the beginning of next month.

Some of the jobs can come back quickly, some could take a new form but some may never return.

What it means for you…

Unless you’re independently wealthy, it’s time to get your ducks in a row.

I’ve drummed on about having an emergency fund that will cover between three to six months of living expenses before. You might even want to consider having one for up to a year – it can only help ease the stress.

Part of that means knowing what your monthly budget is, so find a weekend to sit down and assess what your regular income and expenses are. It can also give you an idea of what you can cut straight away if you lose your job.

You should take into account big spends you have coming up as well, like the fridge that’s in questionable health.

Work-wise it’s time to brush up on your employability.

Before any redundancy happens, there will be a consultation so know what your rights are and what you’re entitled to.

If you want to stay in your job, consider making a list of ways you add value to your employer. You may never have to use it – but if you do, you’ll have it to hand.

Your backup plan might be to update your CV and LinkedIn profile or learning a new skill. That list of ways you add value can also help you think about the transferable skills you have that you can take to another business.

If you are laid off, you might be eligible for benefits such as Jobseeker’s Allowance even if you have savings and the tax credits available to you could change too. Make sure you check these to get the most of what you’re entitled to.

Until the end of October, there are measures in place that could help ease your finances.

For example, if you have an existing credit card, store card or personal loan debt, you can ask to freeze or reduce your payments for three months. For these, it’s in your interest to pay them off as soon as possible as the interest is still accruing.

You can also request an interest-free overdraft of up to £500 on your main bank account and you have up to 31 October 2020 to request one.

Finally, being made redundant isn’t always the worst thing.

I was made redundant from my first job out of university when the 2008 financial crisis began to bite. I retrained as a journalist and it’s been a pretty epic decade.

So, could this be your time for change?