Six months on from lockdown

Next week marks a sorry anniversary: it’s been six months since the UK first went into lockdown in response to the coronavirus pandemic.

When the lockdown kicked in on 23 March, the collective anxiety was palpable. Just over a month later, Boris Johnson announced that we were past the peak, and lockdown restrictions would ease. Joy and relief followed.

The easement started in earnest in May, with people finally being able to see friends and family – at an appropriate social distance of course.

Then came the reopening of non-essential shops in June; and restaurants, pubs and bars in July, as well as of course the permission for international travel.

August seemed almost too good to be true, with fortunes saved on eating out. Now that we are in September, things are looking gloomy again, with coronavirus cases on the up and the prospect of another nationwide lockdown looming.

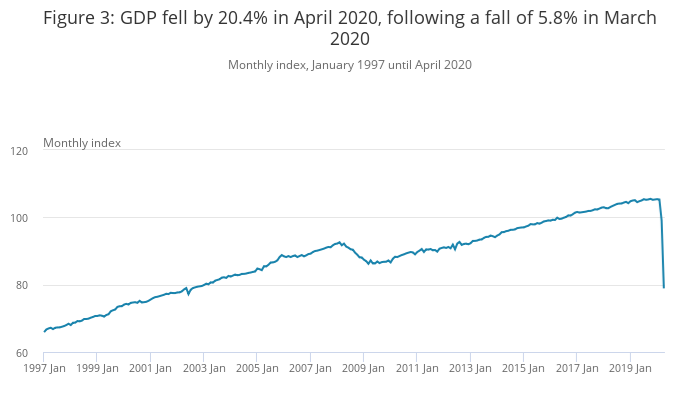

But how is the economy doing in all this? And what about the future?

According to the latest quarterly report on business conditions from the Bank of England, things have picked up, but it’s not expected to be back to pre-Covid levels for some time.

The report is based on conversations with 700 businesses around the country, collected between early August and early September. It’s split into nine sections: Consumer demand, business and financial services, manufacturing, construction, corporate financing conditions, property markets, investment, employment and pay, and costs and prices.

It’s a long report, so I want to focus on some key points.

First, consumer demand is up, but there are great variations between sectors. The retail sector has been buoyed by online sales for example, but in-store sales haven’t quite bounced back.

Overall, the figures look promising. In fact, according to the Office for National Statistics (ONS), the number of goods purchased was 4% higher in August compared to pre-pandemic levels in February.

However, the service industry is still suffering. Demand still hasn’t returned to normal and service providers have to contend with social distancing measures that limit the amount of trade they can do.

Corporate financing conditions (borrowing by businesses) are also looking particularly worrying.

Right now, demand is still strong from smaller businesses, mainly to cover cash flow issues during the restart period. But many will need to renegotiate debt repayment in the near future, which could spell trouble for those who aren’t able to recover to levels necessary to survive.

What’s more, some bigger businesses (defined as having a turnover of over £45 million) – such as those in civil aviation, hospitality and leisure – are struggling to find financing. Needless to say if they fail, many jobs will be lost.

Of course, we’ve known for some time that significant job losses are coming. Currently, 10% of the UK workforce is still on furlough, and according to the ONS, the number of employees on payrolls in August was down around 695,000 compared to March.

But the Bank of England’s report is looking more bleak for the months ahead: Many businesses have frozen salaries, some have enforced pay cuts, and companies in almost every sector are reporting plans to reduce the number of employees.

Given many businesses are delaying future investment, due to coronavirus uncertainty and Brexit, there’s every indicator that long term recovery will be very slow indeed.

The only areas that are more or less back to normal are manufacturing (industry dependent), construction (though new projects still hang in the air) and the property market (mainly housing rather than commercial).

What it means for you…

I’m afraid I’ve painted a rather bleak picture of our dire situation, but it’s not all bad news. As well as signs of recovery in most areas, albeit slowly, it’s worth noting that some sectors are booming.

Companies in food processing and retail, IT and digital services, medical and scientific development, and some financial services have all reported plans to increase headcount, for example.

So as well as being financially prepared, by having an emergency fund in place for example, it’s worth thinking about how you could be more flexible and adaptive right now to improve your employability.

The Financial Conduct Authority (FCA) has also been pushing for more tailored support for borrowers after initiatives such as mortgage repayment holidays end, so if you’re still struggling it’s worth getting in touch with relevant providers to see if they can help.

If you do need more financial help, it could be noted on your financial record in the short term – but it could prevent you from getting into problematic debt in future.