The best time to buy a home may have passed

Thinking about taking advantage of the current stamp duty freeze?

Well, the best time to buy a home has probably already passed – especially if you’ve been furloughed or are a first time buyer.

I say this not to discourage anyone from buying a home right now, but to highlight some of the ways the housing market is conspiring against those who may need to buy homes the most.

Furloughed workers are being rejected outright

For those currently on furlough, getting a new mortgage is becoming near impossible.

While a handful of lenders are still accepting applications from those on furlough, many have simply stopped.

TSB, for example, will only accept applications from furloughed workers if their employers are topping up their salaries to 100%. Even then, the value of their salary is considered negligible when it’s part of a joint application.

The bank specified: “For joint applications which remain affordable on the other customer’s income, employment details should be captured and income keyed as £1 for the furloughed customer.”

This suggests that if you’re applying solo, you should just forget about it.

Nationwide on the other hand will still accept applications from furloughed workers – but only if they’re back at work by 2 November 2020.

Even if you have returned to work, it’s difficult to say whether having furlough on your record automatically makes you a higher risk borrower to lenders. What is clear is that you’ll face more scrutiny over your application, which is now more likely to be assessed by an underwriter rather than an algorithm.

This doesn’t just affect house buyers – if you already own your home and are looking to remortgage, you may find yourself having to opt for a more expensive mortgage because of the lack of options available to you.

First time buyers could be priced out

Even if you haven’t been furloughed, as a first time buyer, you may find yourself facing an inordinate number of hurdles, starting with price.

Estate agent aggregates are beginning to signal that demand is outstripping supply, which is pushing up house prices.

Given the shaky labour market, you may be wondering where this excess demand is coming from. The answer may be investors, for whom money is less of an issue.

In fact, in its latest house price index, Zoopla said the current demand was “unseasonably strong”.

It’s worth remembering that those who already own homes are able to take advantage of the stamp duty freeze as well – they just have to pay the surcharge, which still means a great saving.

Cost aside, mortgage availability and price are also working against first time buyers.

Back in June, I wrote about how high loan to value (LTV) mortgages – basically the ones that require smaller deposits – were starting to disappear from the market. It means first time buyers will have to stump up a bigger stake before they’re able to buy.

But now we’re also beginning to see mortgage rates rising, despite interest rates remaining low.

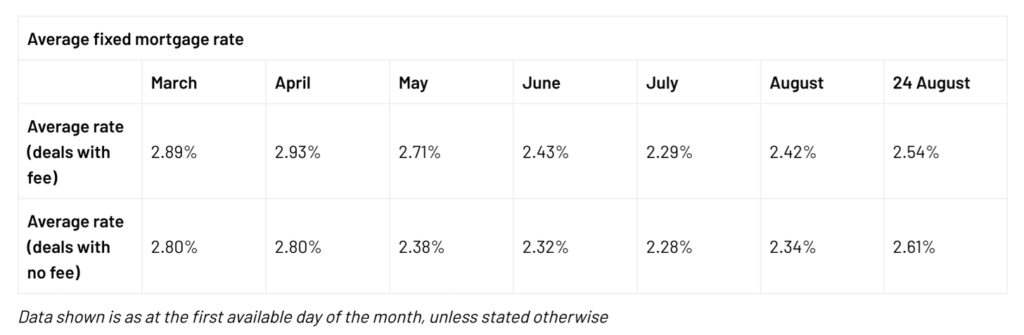

According to Money Facts, the cheapest mortgages were in July when the average fixed rate mortgage charged 2.29% in interest. This has risen to 2.54% as of 24 August.

What it means for you…

Given that house prices have already been artificially inflated by the stamp duty freeze – most experts expect this to fall, though of course it may not – and mortgages are getting more expensive, you can see why I think the best time to buy a home has already passed.

It doesn’t mean you shouldn’t buy of course. The fact is, it depends entirely on your circumstances, specifically your current financial situation and how much you want/need to buy right now.

If you have plenty of disposable income and can buy like an investor, this is a great time to do it. Just make sure you negotiate hard.

But if you’re affected by any of the issues I mentioned, you may want to sit down and work out the numbers – the amount you save on stamp duty vs the extra you’re paying in inflated house prices and a more expensive mortgage – and then decide what to do next.

Either way, if buying is on your cards, do it quickly.