Index funds or ETFs: Which is best for passive investing?

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

Index funds and exchange-traded funds (ETFs) are often confused with each other.

They both offer a diversified portfolio, are known for being lower cost than other investment products, and can be used for passive investing.

The main differences between the two products are the fees and when they can be bought and sold. But depending on your investment strategy, one may be much more suitable than the other.

With that in mind, here’s a comparison of the two investment products.

What is an index fund?

The term index fund is generally used as a shorthand for index-linked mutual funds.

These are basically pots of money pooled from investors that are used to buy investment products like stocks and bonds.

A key feature of index funds is that the portfolio of investment must track a particular index, typically by investing in all or a representative sample of the companies included in the index.

This naturally diversifies the investment, which in theory spreads the risk.

Index funds can be bought or sold via an investment platform, such as Vanguard, Fidelity, or Hargreaves Lansdown*.

They’re traded once a day, typically after markets close, which makes them much better suited to investors with a longer-term outlook.

What is an ETF?

Exchange-traded funds, or ETFs, also hold money pooled from investors.

However, as the name suggests, ETFs are traded on the stock market – so you’re really buying a share of the fund rather than putting your money into it.

Prices for ETFs change throughout the day, and you can buy and sell ETFs at any time during trading hours, rather than having to wait until the end of the day for your purchase or sales request to be processed.

There’s potential for more market volatility here, but savvy investors who have time to watch the market might also make greater gains.

It’s not a great option for novices though, because there’s a greater risk of emotional trading – where big swings in the market trigger impulsive decisions to buy or sell.

To trade ETFs as an individual investor, you’ll need a broker account from the likes of Trading 212, AJ Bell and Hargreaves Lansdown*.

Pros and cons of index funds

Index funds are often considered a good entry point for new investors – they are relatively easy to understand and straightforward to manage.

And because trades are processed once a day and you’re not monitoring prices in real time, they remove much of the temptation to buy or sell impulsively.

The main downside is that they usually come with a minimum investment requirement, which can be quite high.

For example, Hargreaves Lansdown’s threshold is £100 per transaction, which is reduced to £25 if you’re investing via direct debit.

Another key consideration is fees. Mutual funds are typically thought of as more expensive because they tend to be actively managed and therefore have higher fund management fees.

Although an index-linked mutual fund is more passively managed, and is therefore a lot cheaper, they can still have higher fees than ETFs.

That said, many investment platforms will allow you to make mutual fund trades for free, which will keep costs down.

You’d still have to pay to use the investment platform, of course.

Pros and cons of ETFs

ETFs are more attractive to experienced investors or those who want to play an active part in their investment.

There’s no minimum investment requirement for an ETF.

You do, however, need to be able to buy at least one share in the fund, and the price of that one share can be wildly different depending on what you buy. Some might be as low as £10 a share, while others are more than £100.

In terms of management fees, these tend to be significantly lower for ETFs because most of them are passively managed.

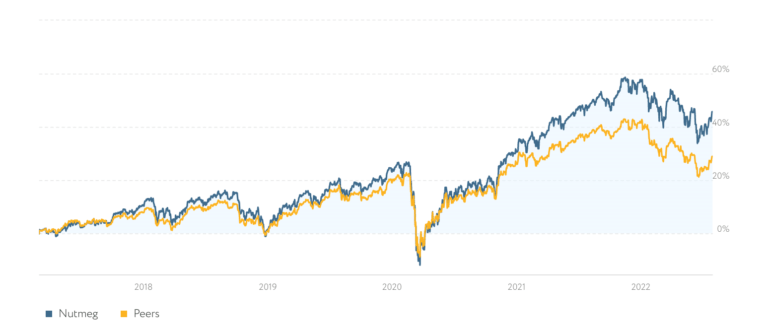

The low fees are one of the reasons why robo-advisor investment platforms like Nutmeg favour them.

That said, investment platforms will typically charge a fee every time you trade an ETF – unlike index funds, which are typically free to trade.

So if you’re buying and selling ETFs regularly, the trading fees can seriously dent your income, and you might even end up with less than what you started with.

Index funds or ETFs: which is better?

Both index funds and ETFs can be used as part of a passive investing strategy – assuming you’re buying and holding your investment, rather than constantly updating it.

However, index funds offer obvious advantages for novices and those who are time-poor.

One reason is that index funds track the market.

It means once you’ve picked your funds, you can just leave it to grow – hopefully as the market grows, the value of your investment will also go up.

Although you can do the same with ETFs, there’s potentially greater gains to be made if you have a more active hand in your portfolio but then of course this stops being passive investing.

To trade ETFs successfully, you would need a solid understanding of how markets work and have the time to track price changes, which makes it harder for those new to investing.

Both products have a place in a well-diversified portfolio. The right choice depends on your investment goals, your level of experience, and how hands-on you want to be.

Pin this for later