How coronavirus is hitting inflation

Hey, what’s on your mind?

Inflation is what’s on mine. If you already know what inflation is, skip straight onto the fun stuff: how inflation affects our daily lives, what’s changing in our “basket of goods” and how coronavirus has affected it.

What is inflation anyway?

Inflation is defined as the rate at which the price of goods and services increase year on year – you’ll experience it as the cost of living increasing or decreasing over time.

Economists like a healthy bit of inflation (hence the Bank of England’s 2% target) because it shows growth in the economy. But if there’s too much, the cost of living spirals out of control – you may remember this as what happened in Germany after WWI. And if there’s too little inflation or even deflation, it’s an indicator we might be moving towards a recession.

The Office for National Statistics (ONS) provides three separate measures for inflation each month: Consumer Price Index (CPI), Consumer Prices Index including owner occupiers’ housing costs (CPIH) and the Retail Price Index (RPI).

“The basket of goods”

All three measures of inflation are calculated using the price changes of a “basket of goods” containing items that the government thinks typical British people buy, ranging from food and drink to travel and clothing.

The items are weighted according to how important they are in the average household’s expenditure. For example, housing and transport eats more into the family budget than education and health, so the latter are given a lower weighting, meaning changes in their prices doesn’t influence the overall inflation rate as much.

The items in the basket change over time, and differ between RPI and CPI (CPIH is just CPI with cost of housing factored in).

Each month, the ONS collates the average prices of the basket of goods (approximately 180,000 prices for around 700 items) and compares them to previous year’s figures to work out the percentage change.

If there’s an increase, you have inflation. But if the figure is negative, you have deflation.

To really complicate things, all three are currently still in use. CPIH is what the government uses to track inflation, CPI is what the Bank of England uses for their target (which could influence how they adjust interest rates) and RPI is used in long term contracts (including some house leases).

Incidentally, the government is currently in consultation to get rid of RPI altogether in the next couple of decades (!), which could negatively affect pensions in the long run.

How inflation affects our daily lives

Inflation rates show us how much more expensive things are getting – if that’s the case – and also how our lives have changed over time.

If you’re buying the same thing all the time, like a bag of flour, you’ll definitely notice if the price went up from 9p to 90p overnight. But if that increase was spread over several years, you probably wouldn’t notice or think about it.

However, if the price of goods is going up faster than your salary, you’d be effectively taking a pay cut. So it’s good to keep an eye on things and make sure you’re still earning your keep.

The ONS has a fun interactive feature where you can plug in your salary to see whether your salary increase (if you get one) is above inflation.

Sometimes, the influence of inflation rates isn’t always obvious.

For example, whether a country has high or low inflation could affect the value of its currency (often through interest rates but sometimes through speculation), this in turn would also affect import and export prices.

Inflation rates can also be used in long term contracts such as house leases and even pensions – but not all of us reads these as closely as we should, or think far ahead into the future.

It’s worth doing so though. You don’t want to be tied to a contract that increases by x times inflation a year when inflation surges to 5% in the future.

How the basket of goods is changing

The RPI and CPI use a similar basket of goods (albeit categorised differently), and each includes items that the other doesn’t. The CPI and CPIH contain university accommodation fees for example, but RPI doesn’t. Meanwhile, the RPI basket includes estate agents’ fees, which isn’t found in the CPI and CPIH measures.

What gets chosen for this imaginary basket can be a fascinating insight into our society and how consumer tastes change over time.

Corned beef, which has been around since the 17th Century, entered the RPI basket in 1947 (when the index started) but fell out of favour in 2005.

Linoleum, video cassettes, VHS tapes, Smash (as in that instant mashed potato), CD players, MP3 players and even Sat Nav have all entered and exited the baskets of the different indexes between 1947 and now.

It’s a veritable who’s who of retro.

The basket for 2020 has just been updated and includes 16 new items:

- gluten-free breakfast cereal

- crumpets (to replace individual fruit pies)

- beef roasting joint (to replace topside of beef)

- fresh diced/minced turkey (to replace fresh turkey steaks)

- vegetable crisps

- pre-mixed spirit drink (as in cocktails in a can)

- reusable bottle/mug for adults

- airport parking

- DVD/Blu-ray player (they were previously separate items and have been merged)

- portable digital music player (to replace MP4 players)

- computer games (will be split into three categories according to platform for more games coverage)

- gin (specifically those served in restaurants and bars)

- burger in a bun (combines ones sold in restaurants and as takeaway)

- self-tanning products

What does this tell us?

Well, gaming is on the up across the board but DVD and Blu-ray are falling in popularity – understandable given the move towards streaming. Portable music players are also falling out of favour because of better smartphones.

On the food side, the inclusion of gluten-free breakfast cereal and vegetable crisps could be a sign that many more Brits are consciously moving towards a healthier lifestyle. Though we clearly still love our booze, especially gin, and burgers.

The rise in reusable mugs and bottles is a good indicator the nation is thinking more about sustainability.

As for self-tanning products… could it be Love Island?

How has coronavirus affected inflation?

For perhaps the first time ever, none of the prices for the latest figures (April 2020) were collected in person. Instead, the prices were either collected online or by staff calling shops.

Many items (90 in the CPIH basket, accounting for 16.3% of the weighting) were no longer available to the public or researchers, such as drinks at the pub or meals out. For these, statisticians decided to rely on historical data to predict what the prices would be in April if these were still available.

Next year, we could see a lot more items dropping out of the basket depending on what happens next.

There were also many items that were out of stock, like loo roll, so no prices were available. For these, statisticians relied on prices of similar products or from a previous period.

For things like housing, they are having to take a similar measure – except it’s further complicated by the fact that statistics for things such as property sales aren’t currently reported due to coronavirus, and are unlikely to be for some time.

How can this be accurate?

All this missing information is an accountant’s nightmare.

There are clear limitations to how inflation is being calculated right now, but for the foreseeable future, it’s the best available solution. And it’s an approach that’s being taken by other countries within the EU to measure their inflation as well.

Even after lockdown ends, we’re unlikely to see a true reflection of the state of things for many months to come.

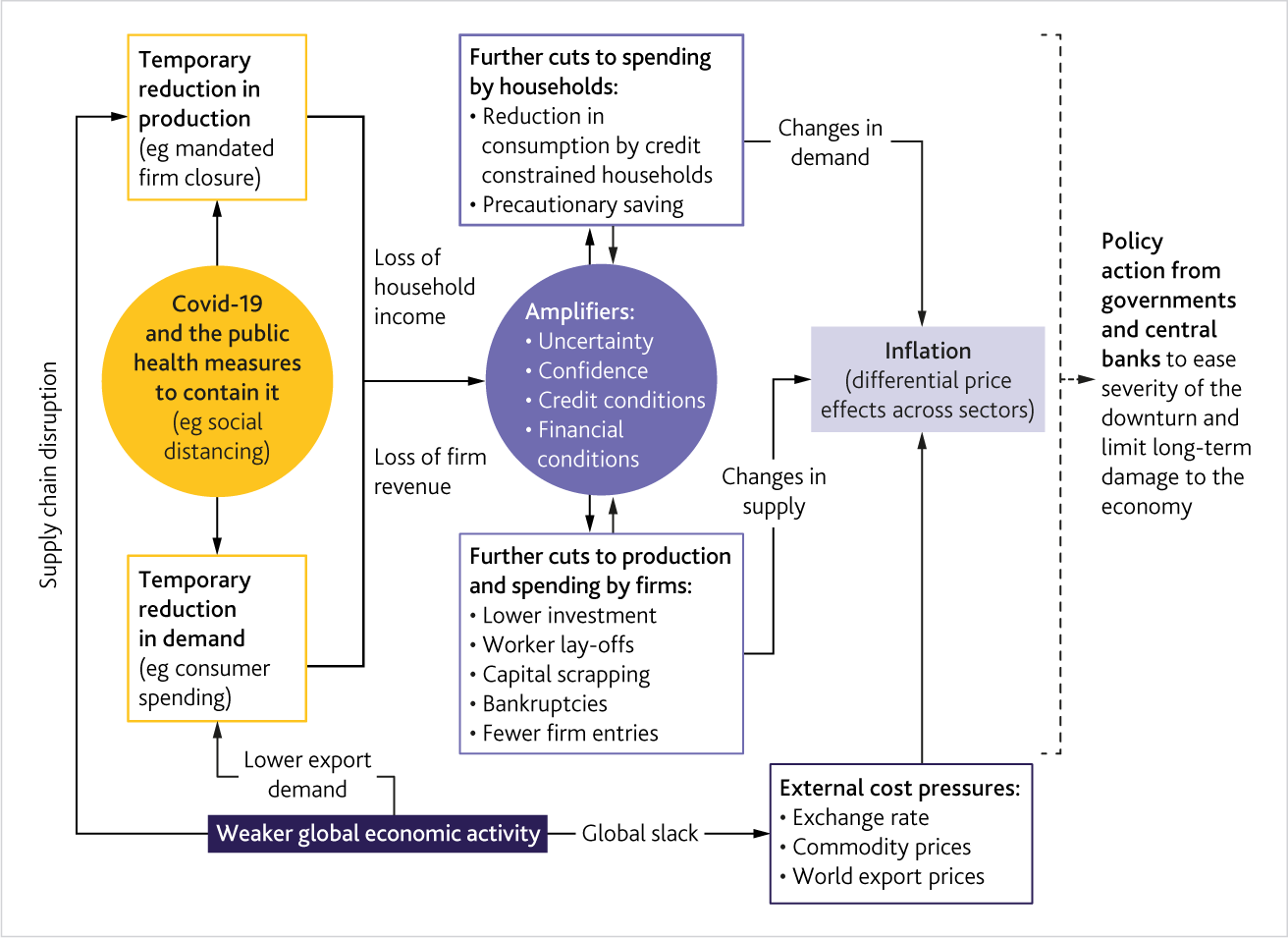

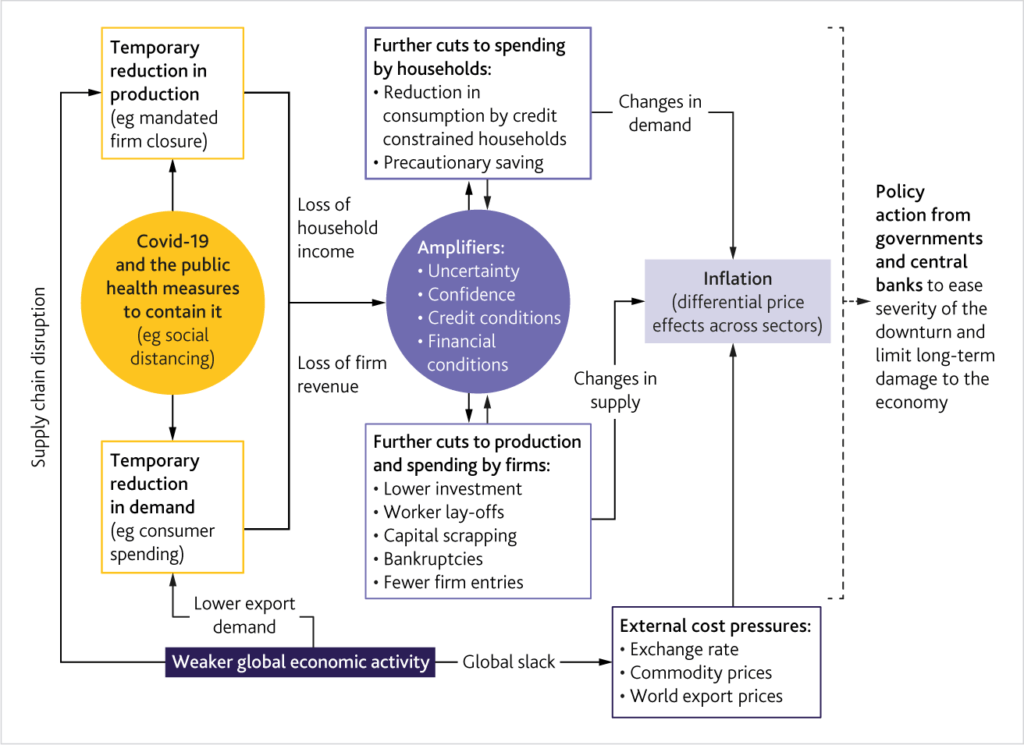

This graphic from the Bank of England show just how many different ways coronavirus can continue to affect the economy.

Meanwhile, the inflation rate is currently at 0.9% (CPIH from April), down from 1.5% in March.

It’s a big drop, but it’s worth bearing in mind one of the biggest drivers of this was energy and fuel prices plummeting between March and April.

The months ahead are uncertain, like everything else. While crude oil prices briefly went negative in April (meaning producers were effectively paying people to take it off their hands), there’s every chance of a big up-swing if aviation get back on track like airlines are planning right now.

One thing’s for certain: what inflation does next will have a big influence on our interconnected lives.