Debt Management Plan vs debt consolidation

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

When I wrote about how getting debt advice works, I wanted to demystify it for those who may need help, and those who may need help without realising it.

Sara Williams, who’s been a debt adviser for over 20 years and writes the brilliant Debt Camel blog, shared some really interesting insights into the different options that might be available to those in debt.

Two main options for getting out of debt popped up: debt consolidation and the Debt Management Plan.

So here I wanted to delve deeper into what they actually mean.

What is debt restructuring?

This was the question that actually started our conversation about debt.

It made me realise that there were so many misconceptions about the process for getting out of debt.

Debt restructuring is normally used in terms of refinancing debt, according to Williams, and there are a few ways you can do this.

One of the most talked about ways is getting a 0% transfer deal.

This is where you transfer your entire debt (or a big chunk of it) onto a 0% interest credit card and then pay that off over time.

You’ll usually have to pay a fee to transfer over your balance, but at least you don’t have interest accumulating on your debt while you pay it off.

Although it sounds like a no-brainer, securing a 0% transfer deal is only possible with a pretty good credit rating, says Williams.

And even then, you’ll have to be careful not to add to your debt.

“The next step down from that is going for a loan, which would allow you to consolidate some or all of your debts and pay it off at a lower rate,” says Williams.

Restructuring your debt in this way can work for some people, but not always.

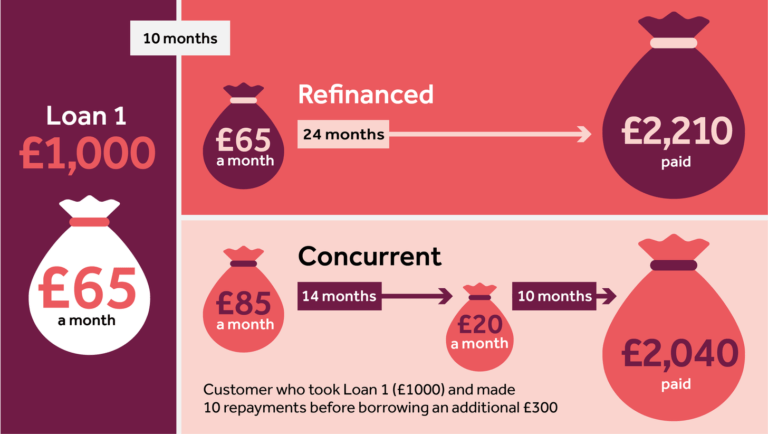

Consolidation loans can push you further into debt

“What a lot of debt advisers are worried about at the moment – in a time when people’s budgets are really under pressure – is that debt consolidation could be one of the first things people think about,” says Williams.

But depending on your circumstances, “this could vary from a really good idea to a really bad idea”.

“Debt advisers have seen too many people for which this consolidation loan is a big mistake,” says Williams. “It’s made your debts superficially look a bit cheaper but it’s actually putting you in a much worse position.”

Williams gives an example of someone who might be paying interest rates of 23%, 33% or even 43% on a credit card.

When they see a loan that’s offering an interest rate of 16% or 17%, they see it as a cheaper option that they can take on to pay off their debt at a lower rate.

But it’s what happens next that can end up being devastating.

“You take this loan to pay off some of your cards,” says Williams. “But you don’t close the card.”

It might be because you’re told it’s good for your credit rating or it’s just there for an emergency, but for whatever reason, you decide to keep the credit card or cards open.

“Then when things are a bit tight – perhaps when the energy prices go up next or Christmas comes round – you use the card again,” says Williams.

“And so you find out in a year’s time you’ve still got most of your debt left because you’ve only been chipping away at this pile here. And your credit cards have been building up again.”

Depending on your credit score, consolidation loans can also be very expensive – maybe more expensive than what you can actually afford.

Instead of jumping on one of these loans in a panic, Williams advises going to a debt adviser to check whether it’s actually the right solution for you.

Debt Management Plan – the alternative to debt consolidation

For those who have been able to handle debt up to now, but are suddenly finding the squeeze a little too much due to how quickly prices are going up, there are alternatives.

One of these is the Debt Management Plan, or a DMP.

It’s often described as a flexible consolidation, but crucially it’s at 0% interest, says Williams, which gives you a better chance of paying off your debts.

To secure this, you would normally have to approach one of the big debt charities such as Step Change.

How a Debt Management Plan works

As part of the Debt Management Plan, you would make just one payment each month to a charity such as Step Change.

“They’ll have arranged with all your creditors that they’re going to divide your payment and pay each creditor a certain amount,” according to Williams. “So you don’t have to discuss this with your creditors – Step Change will do it all for you.”

The idea is that you repay the same affordable amount of money each month for a certain period of time until your debts are paid off.

As the charity doesn’t charge a fee for this, all of your money is going towards paying off your debt.

And as the interest is frozen, you’ll start seeing your debt dropping each month.

Benefits of a Debt Management Plan

A Debt Management Plan is very flexible and can be easily adapted to your current situation

The amount you’re paying is regularly reviewed.

You can also request the review to take place ahead of schedule if your circumstances change, whether that’s because you’ve had a big pay rise or have just been made redundant.

The interest rates on your debts are usually frozen, too.

Your debtors don’t have a legal obligation to do this, says Williams, but most will do at the request of the charity.

It also has the benefit of alleviating some of the stress of being in debt.

Instead of dealing with all your creditors at once, you just deal with the charity, who will then liaise with your creditors on your behalf.

Even while your Debt Management Plan is being set up, the charity can initiate something called “breathing space”.

It means your creditors have to stop contacting you, except in very specific circumstances, such as for court fines.

You can also stop paying your commercial debts until your Debt Management Plan is set up – you’ll still need to pay your priority debts of course, so things like your mortgage and your bills.

Downsides of a Debt Management Plan

While it’s easy to manage and to operate, a Debt Management Plan does harm your credit rating, says Williams.

It can also be quite restrictive as you’ll have to tighten your budget significantly.

That means although you’ll have a reasonable amount of money to live on, you won’t be able to do things like going on holiday.

Plus, any new debts you acquire won’t be covered by the Debt Management Plan, so that’s worth bearing in mind.

And if, while on a Debt Management Plan, you suffer a series of setbacks that mean repaying your debt is going from several years to several decades, you may need to consider insolvency.

Pin this for later