JP Morgan’s new digital-only current account Chase offers 5% interest

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund it. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

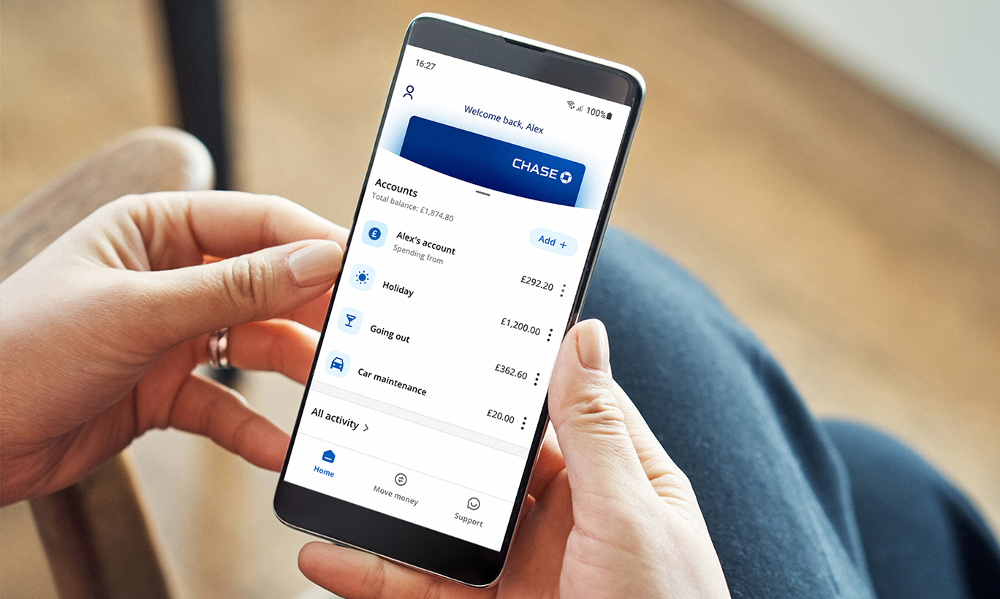

A couple of weeks ago, JP Morgan launched its new digital-only current account in the UK – Chase – and it looks really interesting.

I’ve been waiting for it to fully roll out, but it seems you can only pre-register your interest for now.

As well as cashback on everyday spending, you also get 5% interest on savings – frankly it sounds too good to be true!

Here’s what you need to know.

How to sign up for JP Morgan’s Chase current account

At the moment, JP Morgan is still rolling out the account, which means it’s not available to everyone yet.

You have to register your interest on their website.

If you get picked, you can then register for an account by downloading their app. And then it’s just a case of applying for a bank account in the normal way.

Getting rewarded for spending

One of the draws of Chase is that it rewards you with cashback for spending.

It’s not the only current account to do so of course – Santander’s 123 and 123 lite both offer cashback on bills, for example.

In Chase’s version, you get 1% cashback (rounded to the nearest penny) on just about everything you buy using your debit card, whether it’s online or in-store, in the UK and abroad.

There are some exceptions though, like gambling and betting, as well as (randomly?) purchases in antique shops and estate agent fees.

Your account has to be kept active for you to get the cashback, and it seems that they are only running it for 12 months initially.

There’s potential for the scheme to be extended, but of course they are not making any promises.

Chase’s 5% interest rate

With interest rates so low, there is basically no savings account that beats inflation right now – but Chase could change that with their 5% interest rate.

It will be a slow going process, though.

The high interest rate is only offered as part of their autosave feature where you can choose to round up your debit card spending to the nearest £1.

So if you buy something for £5.99, £6 will be deducted from your current account, 1p of which will go into your autosave account.

Chase will pay 5% interest on this 1p, calculated daily but paid monthly, and you can access the money any time you like.

After a year, any savings in this pot will be sweeped into a Chase current account of your choosing.

Other perks from Chase

Like most current accounts in the UK, Chase is completely free to use.

One great benefit for those who travel regularly is that they won’t charge you to spend money abroad either – whether you’re making a purchase in a shop, or withdrawing money from a cash machine.

Although if you withdraw money, the ATM in the destination might still levy a fee.

Is it worth opening a Chase current account?

Possibly.

For a current account, the cashback and interest rate are great incentives but the way they’re set up means you don’t really get a huge amount of return, unless you spend a lot of money via debit cards.

The cashback is for just a year initially, and could be withdrawn any time. It will also take you a while to accumulate substantial amounts of money by rounding up.

And although there are alerts for spending and fraud detection, and your money up to a total of £85,000 is protected by the Financial Services Compensation Scheme, you don’t get the same level of coverage as a credit card.

If you’re already thinking about switching from your current account though, it might just be worth it.