How to invest in cryptocurrency

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

When Bitcoin launched more than a decade ago, financial traditionalists were left frothing at the mouth at this young upstart.

Since then, cryptocurrencies have boomed into a market worth more than a trillion. And some might say they have become mainstream and possibly even essential.

You can’t get in on the NFT (non-fungible token) action without having a crypto wallet, for example.

But how easy is it to buy or sell cryptocurrencies? Is your money safe? And can you make lots of money through cryptocurrencies?

Here’s a beginner’s guide to all those questions.

What are cryptocurrencies?

Cryptocurrencies are basically digital assets secured using a string of code that makes it difficult to counterfeit or double-spend.

Those who use it see it as a currency like any other, while the Financial Conduct Authority (FCA) sees it as a risky investment asset.

The very nature of currencies means that its value is dependent on supply and demand.

In the case of cryptocurrency, the supply of each currency is limited by the number of codes available to secure it and the demand obviously depends on how many people want to own a share.

This is one of the reasons why cryptocurrencies fluctuate in price so much – there is a lot of speculation around them, which can cause demand to shift dramatically.

What are the main cryptocurrencies?

Bitcoin is the biggest cryptocurrency in terms of market share. It’s followed closely by Ethereum.

Which cryptocurrency comes next depends on who compiled the list and when they compiled it, since both the value and number of cryptocurrencies change continuously.

Generally among the top 10 you’ll find Bitcoin Cash, XRP (Ripple), Cardano, Stellar, Litecoin, EOS and USD Coin.

But new cryptocurrency are being created all the time, which can of course shift the landscape.

Are there any benefits to cryptocurrencies?

Cryptocurrencies have evolved a lot since their inception. So while there are some benefits, policy changes are constantly eroding these.

An independent currency

One of the things that made cryptocurrencies popular early on was the fact that they’re independent of central banks and are theoretically free from political manipulation.

But given the amount that cryptocurrencies have been fluctuating in value in recent years, especially after tweets by celebrities and high profile individuals, that might not be the case any more.

As they become more mainstream, they also face greater regulation and this varies from country to country.

In the UK, cryptocurrencies are only regulated for money laundering purposes. Beyond that, you’re free to trade it and bear all of the risks that comes with it.

Private transactions

In terms of privacy, there is definitely more of that. But cryptocurrencies are certainly not untraceable.

And when you come to cash out, you’ll likely still have to interact with a traditional financial institution such as a bank.

Lower fees

There are supposedly lower fees associated with cryptocurrencies, although this is less of a benefit in the UK where the majority of bank accounts are free.

You still need to pay “taker” or “maker” fees when buying or selling cryptocurrencies.

In some cases, you may also need to pay a platform fee, and there are taxes to consider as well (see below).

Perhaps the biggest benefit of cryptocurrencies is that you have the potential to win big if you get in early enough.

Risks associated with cryptocurrencies

Risk is perhaps the biggest deterrent to investing in cryptocurrencies. And the risks are even higher with a new cryptocurrency.

Price volatility

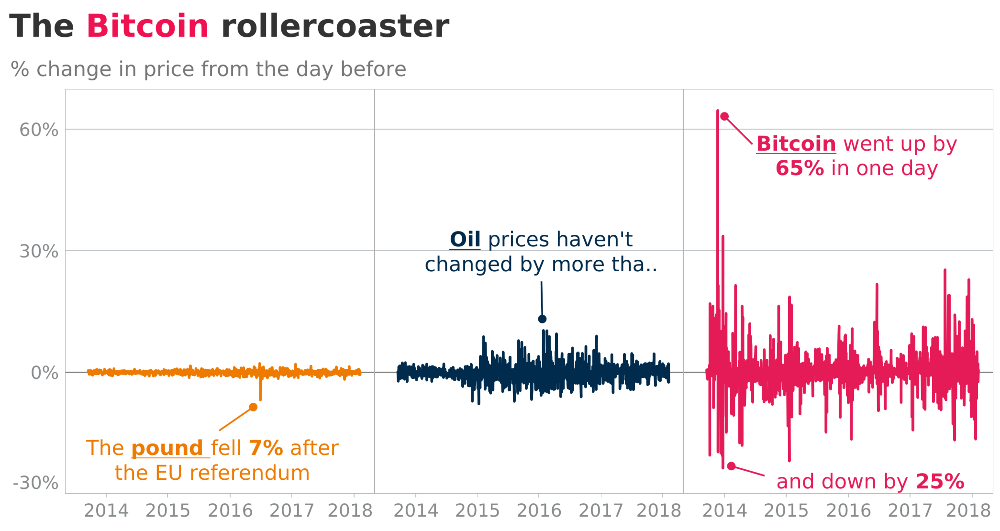

Perhaps the biggest risk of investing in cryptocurrencies is the volatility. And cryptocurrencies are more volatile than most traditional forms of investment.

Take Bitcoin, its value has dropped down to £500 and surged to £30,000 in the past.

Just imagine how much money you’d lose if you bought in at £10,000, and then needed to cash out just as the value falls to £5,000.

Of course, ideally you’d leave your money in until the value goes back up, but there’s no certainty that it will, and you might not be able to afford to.

The Bank of England actually produced an incredibly helpful graphic that compares the volatility of Bitcoin to the pound and the prices of oil.

Blocked access

When there are a lot of market fluctuations, a currency trader can temporarily shut down to stabilise trades.

It means you might not be able to cash out when you expect to, or have access to your money when you need it.

Uncertain payoff

Until there’s a substantial user base, the value of a new cryptocurrency will remain low.

This is ideally when you want to buy in.

But you’re gambling on the fact that your chosen cryptocurrency will become a success.

There is no certainty that other people will buy in too, which means prices could remain low for years or longer.

In some cases, cryptocurrencies can also be discontinued completely.

Lack of financial security

As with any other asset, it’s possible for your cryptocurrencies to be stolen. And you could also fall victim to scams.

You’re not financially protected in any way in either of those scenarios.

In the UK, you won’t have access to the Financial Services Compensation Scheme (FSCS) if things go wrong. That extra protection is available to money held in traditional banks.

How to reduce your cryptocurrency risk

If you do want to invest in cryptocurrencies, there are some ways you can reduce the risks.

To start with, don’t invest more than you can afford to lose. Or as the FCA says, be prepared to lose all your money.

This of course applies to any kind of investing, not just in cryptocurrencies.

You should also spread your risk. That means having your investment in different products and spread across different platforms.

And of course, never underestimate the importance of doing your own research.

What might be a good strategy for someone else might not be for you.

Where can you buy or sell cryptocurrencies?

Places to buy and sell cryptocurrencies are significantly fewer in the UK compared to the US.

The world’s largest cryptocurrency exchange by volume is Binance*. It was banned from conducting any “regulated activities” in the UK by the FCA in June 2021.

Coinbase* is a well known alternative. It became a publicly traded company in 2021 when it floated on the New York Stock Exchange.

You can also trade on a number of apps such as Crypto* and Revolut.

Before you sign up for any of these, or make an investment, make sure you’re aware of all the risks.

And of course, like any other investments, you should seek professional advice if you’re unsure.

Look for an FCA-regulated financial adviser rather than someone off TikTok or Instagram.

Paying tax on cryptocurrency

Cryptocurrency is taxable in the UK and how you’re taxed will depend on how often you buy and sell it.

Depending on how the trades are set up, if you buy and sell cryptocurrency on a regular basis, it might be considered trading.

This means you will have to pay income tax on profits.

For everyone else, Capital Gains Tax (CGT) applies at any disposal event.

That means whenever you’re spending, trading (for another cryptocurrency for example), gifting or selling.

This is because cryptocurrency is considered an investment product rather than currency by the HMRC, so tax on cryptocurrencies work in a similar way to buying or selling shares.

If you made money, you would pay CGT, but if you made a loss you could offset this against any gains.

The HMRC has pretty detailed guides on how income tax and CGT applies in different circumstances.

And of course every individual has a capital gains tax allowance, currently £3,000 a year, below which you don’t need to pay any CGT.

This post was originally publish in July 2021. It was updated in July 2024.

Pin this for later