Monzo Flex: Buy Now Pay Later turned credit card

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

Monzo launched its Buy Now Pay Later product, Monzo Flex, back in 2021.

Since then it’s changed into a fully-fledged credit card offering Section 75 protection.

But unlike other credit cards, users still have the option to pay in interest-free instalments over a period of three months on some purchases.

It’s an interesting proposition, combining features from a few different credit products.

With all that in mind, here’s what you need to know about Monzo Flex.

How Monzo Flex works

Monzo Flex is all about flexibility so you can use it in two different ways.

As a credit card

The main way is of course as a straightforward credit card.

That means for purchases of between £100 and £30,000, you get Section 75 protection.

It’s a form of borrowing so you get to build up your credit score.

It’s also a great option for travellers because there are no commissions or fees to pay on expenditure abroad.

But like a regular credit card, you have to pay off your balance each month (unless you’ve opted for the Buy Now Pay Later option) or be saddled with interest payments.

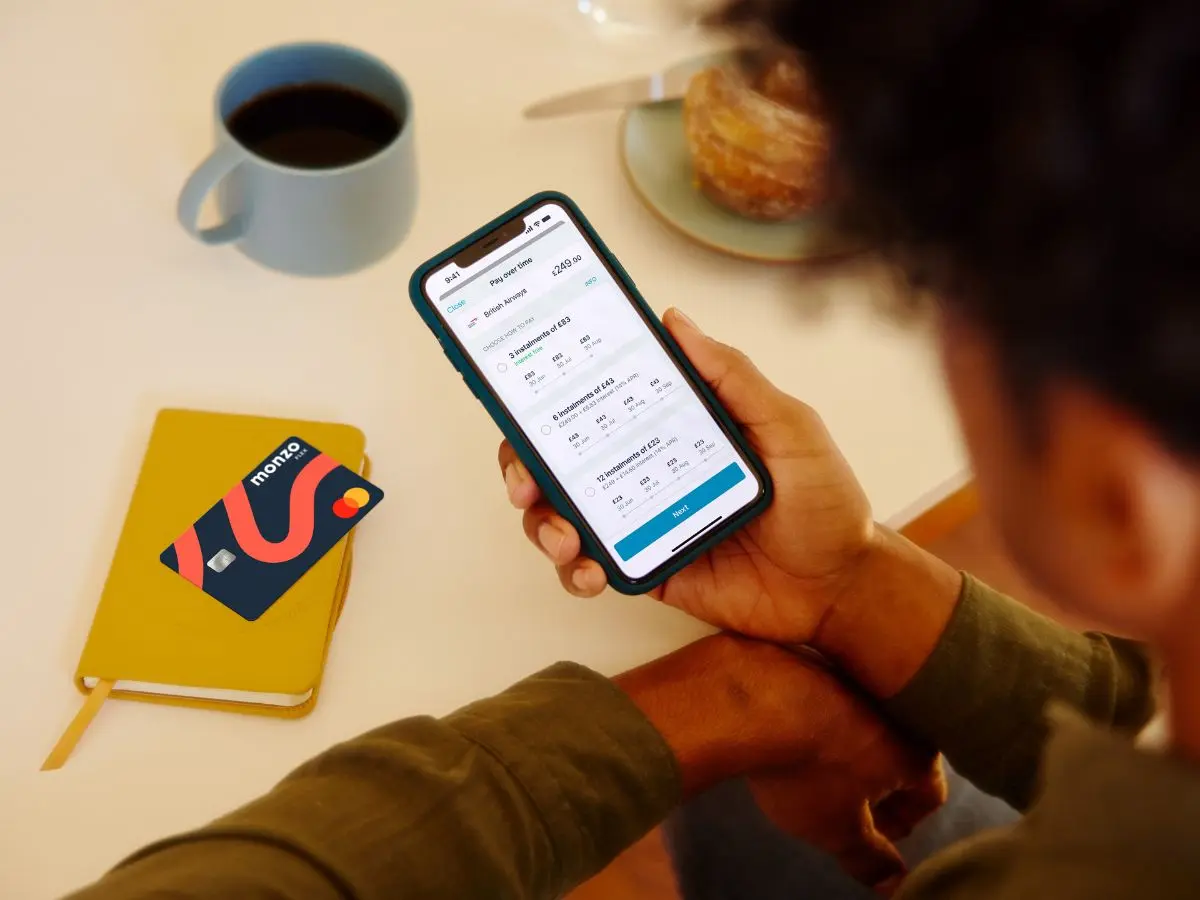

As a Buy Now Pay Later product

If you checked out Monzo Flex when it was purely a Buy Now Pay Later product, things have changed.

If your purchase is over £100, you now have the option to pay for it under the normal credit card terms, or to use its Buy Now Pay Later function.

The Monzo Flex Buy Now Pay Later function is free if you split your payment into three, to be paid over three months.

This makes a big spend much more manageable compared to your average credit card.

And you can split the payment for every purchase over £100 – the third just gets added to your balance for that month.

You’d still have to pay off your balance in full each month if you don’t want to pay extra in interest – but it would be a third of what you’d normally pay.

It’s also possible to pay off any outstanding payments early.

As a loan product

Instead of splitting your payment into three, you can also choose to split your payments into monthly instalments of up to 24.

Monzo doesn’t call this third function a loan but that’s essentially what it is.

If you do this however, you’ll incur an interest at the variable rate of 29% APR.

This rate of borrowing is incredibly high, so only do this if you need to and if you don’t have access to cheaper forms of borrowing.

Again, you can choose to pay off the balance early.

How to apply for Monzo Flex

You can apply for Monzo Flex on the Monzo website. However, you need to have a Monzo current account first.

And then all the other usual rules apply – like being over 18 and a UK resident.

If you’re unsure whether you’d be approved, you can check your eligibility first.

This soft check doesn’t affect your credit score.

But once you apply, the bank will then run a hard check with one of the three credit reference agencies (Experian*, Equifax or TransUnion).

Depending on what your credit history is like, Monzo will then reject you or approve you and give you a credit limit of up to £10,000.

How Monzo Flex will affect your credit score

When you first apply for Monzo Flex, the company will run a hard check on your credit history.

This means it will leave a note on your account that other lenders can see.

And if you apply for too many credit products in a short space of time, it might be seen as a sign of financial distress, which means fewer if any lenders will offer you credit in future.

How you use the product will be reported to credit reference agencies, too.

If you consistently pay off your outstanding balance, without missing or being late for a payment, this will be viewed positively.

In the long run, it means other lenders will see you as a responsible borrower and are more likely to lend to you or offer you better rates.

If, however, you miss a payment, your credit score will be negatively affected so this is worth bearing in mind.

What happens if you miss a payment?

Monzo Flex payments are automatically deducted from your Monzo account, and you’ll get an alert before that happens.

Obviously if you don’t have any money in your account, or have an overdraft, you’ll miss the payment.

The one benefit that Monzo Flex has above other forms of borrowing is that it will give you another seven days to pay.

After that, it will look at splitting your debt into more instalments so your monthly repayments are smaller.

You will have to pay more interest in the long run if this happens, but the individual payments might be more manageable.

And if you continue to miss payments, Monzo will report you to credit reference agencies, which will negatively affect your credit score.

Is there a minimum spend?

When Monzo Flex first launched, it was more of a Buy Now Pay Later product, which meant there was a minimum spend.

Each transaction had to be at least £30.

However, since it’s turned into a credit card, a minimum spend no longer applies.

That said, if you want to use the split payment function, your purchase has to be over £100.

Should you get Monzo Flex?

I’m a big fan of cashback and reward credit cards so the appeal of Monzo Flex isn’t immediately obvious.

But actually, if you stay on top of things, it can be a financially savvy switch.

In most cases, cashback credit cards will only give you up to 5% cashback on the first couple of months before dropping down to 1% or less.

In contrast, it’s still possible to get savings accounts that offer 5% interest or more.

So if you choose the split into three Buy Now Pay Later option, you’ve essentially got two months’ interest free borrowing – assuming you pay off your balance every month.

That money, deposited into a high interest savings account, would earn you more than what you would earn on standard cashback rates.

Of course, given you can only use the Buy Now Pay Later function for transactions over £100, you’d still be much better off using a cashback credit card for smaller spends.

That is, if you can be bothered with all the chopping and changing.

This post was originally published in September 2021. It was updated in December 2024.

Pin this for later