Working more is just not worth it

What to read right now…

Results are in: a four-day work week is great for just about everyone.

Meanwhile, working more is just not worth it – an interesting look at the labour shortage in the UK.

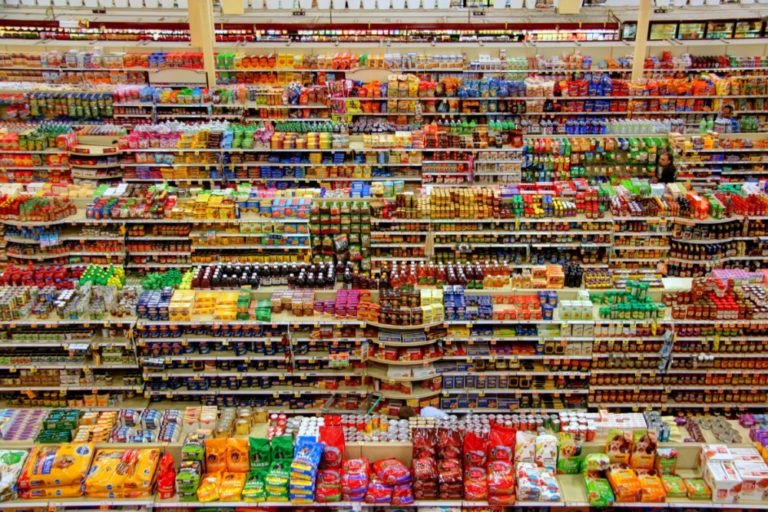

Low fat milk, sugar, cheese and eggs are the items hit hardest by inflation (apart from gas and electricity). So is the answer to simply change your diet?

Natwest will double its mortgage overpayment allowance from March, going from 10% to 20% of the outstanding balance. This is hugely exciting as you can save a fortune on interest payments and pay off your mortgage quicker if you can afford to.

I wrote a guide to whether you should be overpaying your mortgage a while ago that delves into some of the benefits. I do it, but it’s definitely not for everyone.

The deal that’s a steal…

Got some Virgin points saved up? There’s currently 30% off reward flights on Virgin Atlantic, with fares starting from 12,600 points plus taxes and fuel charges.

The discount is available on flights from London Heathrow to Atlanta, Austin, Boston, Los Angeles, Miami, New York, San Francisco, Seattle, Tampa, Washington, Antigua, Islamabad, Lahore, Mumbai or Tel Aviv, or from Manchester to New York.

You’ll need to book by 28 February and travel by 31 May to get the discount though.

To see what’s available, you just have to plug in your travel plans on the Virgin Atlantic website* and then select “show prices in points” in the advanced search bit and it’ll show you how much you have to pay plus alternative dates that might be cheaper.

Do compare prices before you book though because on some routes the taxes and surcharges you pay can be pretty close to what you would pay if you just booked the flight in cash.

And you don’t have to be a frequent flyer to collect points with Virgin at all!

In fact, I rarely fly with them but have enough stashed away for several trips through a mixture of Tesco Clubcard vouchers* and a Virgin Atlantic credit card* (I no longer have one though as I prefer a cashback card to a reward card).

And an actual freebie…

Uswitch has apparently ventured into the current account comparison business and right now it has an exclusive switching offer for First Direct.

If you switch your current account over to First Direct, but via Uswitch, you’ll get the usual £175 switching bonus offered by the bank plus a £30 Amazon gift card from Uswitch.

This makes it one of the most generous switching offers around, assuming you’re looking to change your current account of course.

It’s not the only bank switching offer around at the moment though. I’ve rounded up a few here.

And as usual, here are some things to consider before you make the switch.

If you only do one thing…

Haggle with your broadband provider.

Lots of companies are putting up their rates at the moment but depending on the terms and conditions of your contract, you might be able to leave before that price increase kicks in.

Before you go, they’ll do the usual dance of trying to offer you a better deal so have a look at what deals are available from their competitor before you call.

It’ll make negotiations that much easier if you can show that there are alternatives to your current provider.

Of course, it’s much more convincing if you actually intend to leave.

I did this a while ago with TalkTalk and saved £54 a year on what I would have been charged.