Rail fare could rise by 3.8% next year (even though inflation fell)

The Office for National Statistics released the inflation figures for July 2021 this week and it’s fallen slightly compared to June.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) measure of inflation for the 12 months to July 2021 is now 2.1% (still slightly above the Bank of England’s target), down from the 2.4% in June.

But it seems this change may only be temporary as discounts in clothing and footwear, due to summer sales, was one of main reasons why inflation has fallen slightly.

To complicate things, the usual seasonal fluctuations in clothing and footwear costs are out of sync with previous years because of coronavirus and various lockdowns.

In effect, inflation might appear much higher or lower than normal compared to previous years because prices are no longer rising and falling at around the same time of the year.

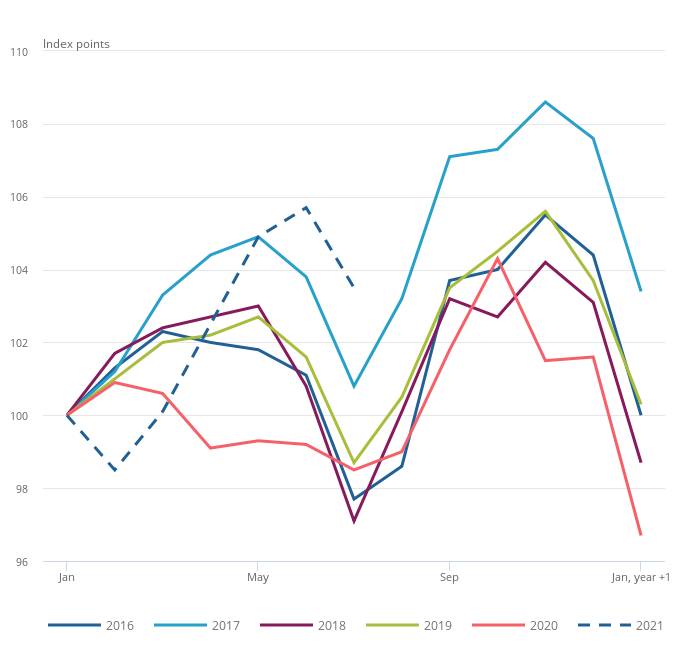

The graph below shows just how out of sync things are – it shows the clothing and footwear price indices from January 2016 to July 2021 (they all start at 100 in January).

Trying to crunch the numbers on that one, I imagine, is proving to be a bit of a nightmare.

What we do know is that at 3.8%, the Retail Price Index (RPI) measure of inflation for July 2021 is at its highest for a long time and July’s figure is also the basis for calculating rail fares for the coming year.

This means for commuters, rail fares can rise by as much as 3.8% from next January.