Positive outlook from mortgage lenders?

A couple of new mortgage products launched this week, indicating that lenders may be feeling quietly optimistic about the property market.

Metro Bank launched their “near prime” residential mortgages, which are basically targeted at those with “imperfect” credit histories who might struggle to get a mortgage elsewhere.

The lender will accept applications from those who have lower than average credit scores, and those who have had unsatisfied county court judgements (CCJs) and defaults of up to £1,000, with no requirement for these to be repaid before the end of the loan term.

Borrowers can take out a mortgage of up to 80% loan-to-value for a new or existing property.

These near prime mortgages are a bit more risky, which is why many lenders avoid them.

To account for that extra risk, the interest rates for these mortgages are higher than comparable products for those with better credit scores. And of course, applicants will still need to be vetted.

Another new offering comes from mortgage broker Habito, who have just launched Habito One, a product where you can fix the interest rate for between 10 to 40 years.

It’s a very interesting proposition considering most mortgages don’t even go up to 40 years.

The interest rates for this one ranges from 2.99% to 5.35% at the moment, which is more than many shorter fixed-term mortgages on the market, but there are a few perks.

Aside from knowing exactly what you’re paying off each month for life (of your mortgage), there are no exit fees if you want to leave early, no charges if you want to pay off your mortgage early (say if you received an inheritance), and you can take your mortgage with you if you move home.

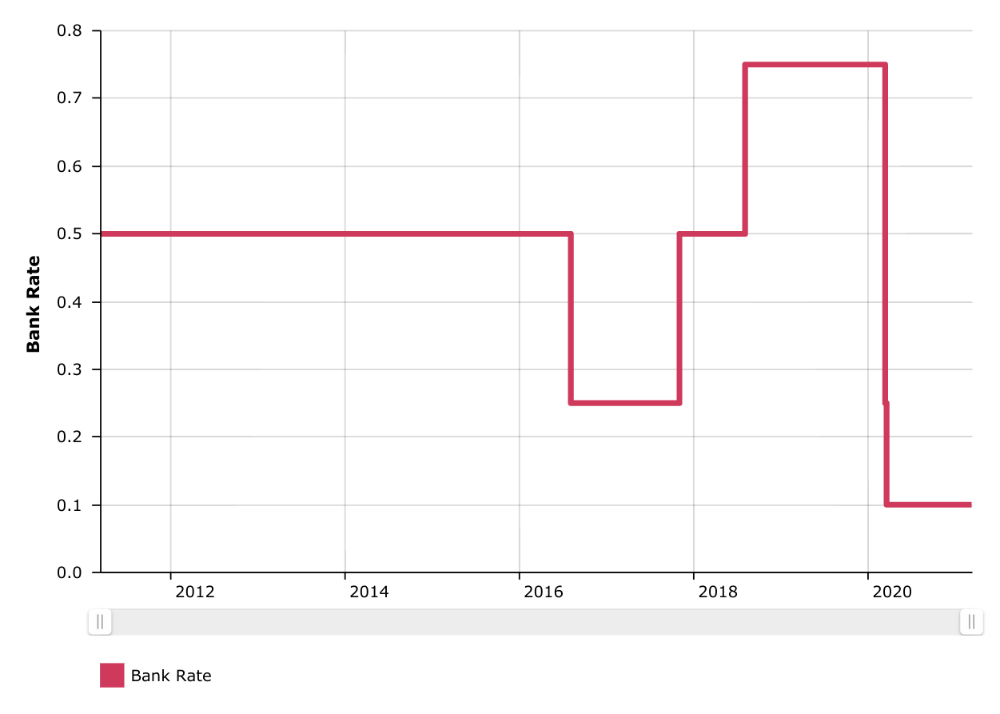

It’s worth thinking about this in the context of the Bank of England’s bank rate, which lenders generally peg their interest rates against.

The bank rate has been less than 1% for more than a decade – since shortly after the last financial crisis – and is currently at an all-time-low of 0.1%. That said, it has been as high as 17% in the past.

So if interest rates go up significantly in future, Habito One would be great value for money – otherwise you should weigh up the value of those extra perks as well as offers from other providers.