A National Insurance scam is on the rise

Action Fraud has issued a fresh warning about a National Insurance (NI) scam after receiving 34,000 more reports from the public about it last month compared to February 2020.

Fraudsters would target victims through automated telephone calls with messages that say their “National Insurance number has been compromised”.

They are then told to press one on their handset to be connected to the caller to get the issue fixed and get a new NI number.

Once connected, the scammers would then pressure their victims to hand over personal details that could then be used to commit fraud.

Pauline Smith, head of Action Fraud, said: “We are asking the public to remain vigilant and be cautious of any automated calls they receive mentioning their National Insurance number becoming compromised.

“It’s important to remember if you’re contacted out of the blue by someone asking for your personal or financial details, this could be a scam.

“Even confirming personal details, such as your email address, date of birth or mother’s maiden name, can be used by criminals to commit fraud. If you have any doubts about what is being asked of you, hang up the phone. No legitimate organisation will rush or pressure you.”

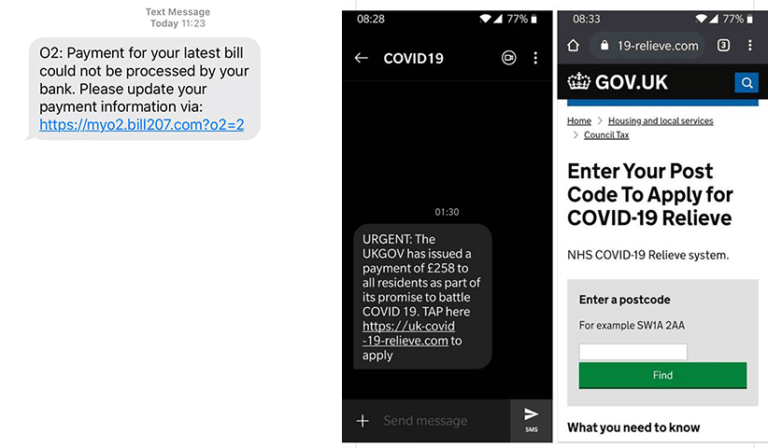

There are actually a few similar scams around and some are incredibly sophisticated.

One Royal Mail scam saw the victim being sent a text message asking them to pay an extra fee for delivery – to be clear, Royal Mail wasn’t actually involved, but their likeness had been appropriated by the fraudsters

The form she used captured her information, which was then used by a criminal to contact her and extract her entire savings.

Action Fraud advises that whenever you receive an unexpected call, text or email that’s asking for your personal or financial details, stop to think for a moment about whether it could be fake.

A lot of mistakes can be made in haste so if you’re not sure, you can always hang up the phone or disengage and contact your bank through official channels.

If you have been scammed, make sure you report it to Action Fraud and of course to your bank to cancel any cards.

Where your personal details have been given out, you can also register with fraud prevention service CIFAS to prevent fraudsters applying for loans and other credit in your name.

It means you will also have to go through extra checks when you apply for financial products in the future.