Nutmeg review: Fully Managed vs Fixed Allocation portfolio

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

In 2021, I decided to experiment with my Nutmeg portfolio because I wanted to know whether I was making the most of my investments.

Specifically, I wanted to compare Nutmeg’s hands-on Fully Managed plans with their more passive Fixed Allocation plans to see whether I could make a saving on fees and still get the same returns.

So in this second part of my Nutmeg review, I want to explain how it worked and of course reveal the outcome.

Fully Managed vs Fixed Allocation: what’s the difference?

Nutmeg’s Fully Managed plan was the product they launched with, and what I started on.

It’s more forward looking, with a team of experts analysing what’s happening in the world daily and adjusting their investment strategy to reflect that.

Because of this, it’s quicker to react to changes in market conditions. That can go both ways of course.

The Fixed Allocation plan was their second product, which they launched in 2017.

It’s more backward looking. That is, the portfolio of investments are adjusted once a year, with the strategy devised using past performance data.

Because of that, if something unexpected happens in the market, there is no way to react to it until the next portfolio adjustment. But it’s significantly cheaper because there’s less human intervention.

Both of these plans focus on exchange traded funds (ETFs), which are low cost.

They also invest in a diverse range of companies across different countries, so you get to spread your risk.

How my Nutmeg experiment worked

To see whether I should switch from a Fully Managed plan to a Fixed Allocation one, I decided to test the performance of the latter.

I opened three Fixed Allocation investment pots on the same day, each set to a different risk level. These were: Balanced (3/5), Growth (4/5) and Adventurous (5/5).

For context, on a Fully Managed plan, you can choose a risk of anywhere between one to 10.

This will determine the type of investments that Nutmeg will put your money in.

For a Fixed Allocation plan, you only have five risk levels.

Given my Fully Managed plan was set to 9/10 for risk, I decided to test the three higher risk levels on the Fixed Allocation plan.

I deposited the same amount of money in each one in July 2021 specifically so I could see how they would perform against each other and, to a lesser extent my Fully Managed plan.

How my Fixed Allocation pots performed

In the first few months of the experiment, all three pots were seeing steady growth, but at different rates.

The Balanced pot saw the slowest growth, achieving highs of 3.9%; the Growth pot saw medium gains, achieving highs of 5.5%; and the Adventurous pot saw the highest growth, achieving highs of 7.6%.

When markets across the board dipped in 2022, these three pots all dipped too but at different rates.

In the first part of 2022, there were two big market dips – during the Russian invasion of Ukraine in February, and one in June in response to surging inflation.

During this time, the Balanced pot fell by a maximum of 12.3%; the Growth pot fell by a maximum of 10.7%; and the Adventurous pot fell by a maximum of 9.3%.

All of my investments were basically worth less than what I had put in.

As a point of reference, my PensionBee portfolio dipped in February but hadn’t actually recovered much by June so visually it just looked like a long decline rather than a double dip.

So while my Nutmeg portfolio fell in value, at least it recovered fairly quickly in between.

When I re-evaluated my experiment at the end of August 2022, my Nutmeg pots were still working towards recovery following another inflation-related dip.

The recovery followed the same trends as before.

The Adventurous pot was recovering the fastest (in the black by 0.27%), followed by the Growth pot (in the red by 3.39%). The Balanced pot still lagged behind, and showed a loss at 7.41%.

Bearing in mind that the fee is the same regardless of the rate of growth, the Adventurous option was clearly giving me the best returns out of the three Fixed Allocation pots.

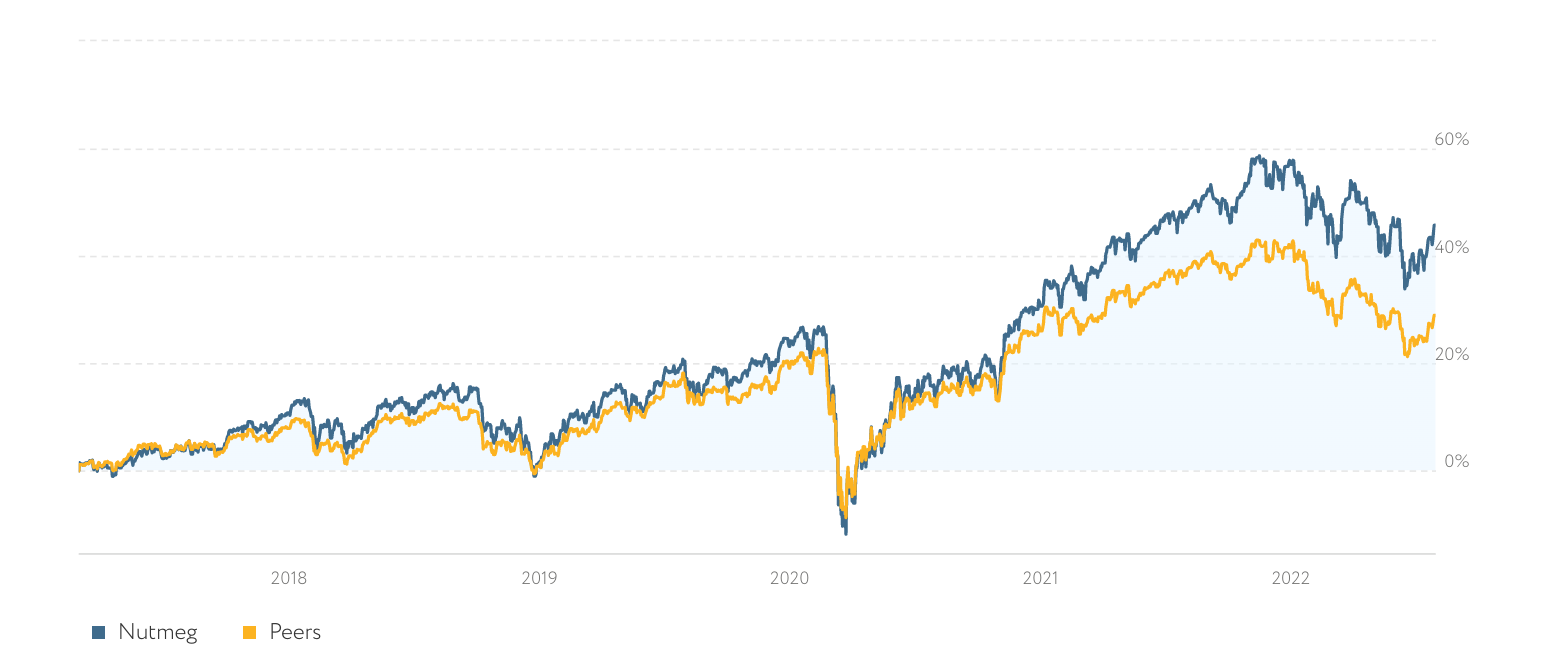

Nutmeg Fixed Allocation vs Nutmeg Fully Managed

It’s slightly harder to compare my Fixed Allocation pots fairly with the performance of my Fully Managed pot because I deposited a different amount of money at a different time, which could affect performance.

That said, based on first-glance numbers alone, my Fully Managed pot had outperformed the Fixed Allocation pots at just about every turn over the last year.

In general, it saw higher growths (8.05%), lower falls (7.06%) and better recovery in between.

It seemed to be more responsive and better at reacting to the economic climate – a valuable trait when the market was so volatile.

Except in August 2022, the Adventurous pot was outperforming my Fully Managed pot, with a growth of 0.27% versus a loss of 0.12%.

The difference in performance was almost negligible, but the fee wasn’t.

Fixed Allocation then, it seemed, had the potential to outperform Fully Managed and comes with a lower fee.

Why I left Nutmeg

I started thinking about leaving Nutmeg in August 2022, a year into my Fixed Allocation vs Fully Managed experiment.

It was a “it’s not you, it’s me” scenario. There was nothing wrong with Nutmeg necessarily but my needs had changed.

When I first joined Nutmeg in April 2020, I was at the start of my investing journey.

At the time I wanted something that was easy to use and I didn’t want to spend a lot of time on it.

By August 2022 I was looking for lower fees and was happy to be a bit more hands on.

In those two years, I had more time to read and learn about different funds thanks to writing the weekly Money Talk newsletters.

It meant I was much more comfortable with picking my own funds and, based on my experiments with Hargreaves Lansdown, it seemed to be going well.

Hargreaves Lansdown was much cheaper too.

And so, I started the slow process of leaving Nutmeg.

It took me over a year to wind up my investments at Nutmeg and transfer to Hargreaves Lansdown.

The main reason was because my portfolio took so long to recover, and that wasn’t Nutmeg’s fault.

In September 2022, then-Chancellor of the Exchequer, Kwasi Kwarteng, delivered a disastrous mini budget under the brief reign of then-Prime Minister Liz Truss.

It triggered a market meltdown, and sent investments plunging.

While my Fully Managed pot managed to turn things around after a couple of months, the Fixed Allocation pots were much slower to recover.

In fact, it wasn’t until early 2024 that all three Fixed Allocation pots were back in black.

Once I was ready, the actual process of leaving Nutmeg was really easy.

I just filled in the form on Hargreaves Lansdown‘s* website and they got in touch with Nutmeg and sorted everything.

It only took a couple weeks and was really no different from doing a bank switch.

The verdict on Nutmeg

As I said at the start of this two-part Nutmeg review, I really liked Nutmeg.

I found it easy to use and the returns were pretty good, at least on the Fully Managed option that I chose.

Ultimately what made me leave Nutmeg was that Hargreaves Lansdown offered me a better deal. The fees were lower anyway but they offered me a discount on top of that quite out of the blue.

In terms of recommending Nutmeg, yes I would absolutely recommend it.

Based on my experiment, and the market downturns since, I would go for the more expensive Fully Managed option.

Although the Fixed Allocation option has the potential to beat the Fully Managed option in normal conditions, the long recovery after the mini budget really made me think twice.

Read this: Nutmeg vs Hargreaves Lansdown: Which is best?

This post was originally published in August 2022. It was updated in 2024.

Pin this for later