Nutmeg review: An investment platform for beginners

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund it. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

I used investment platform Nutmeg for four years and I loved it.

It’s easy to use, there’s no hassle and the returns have been pretty good.

But after an experiment I started in 2021, I decided to leave the platform in 2024.

In the first of this two-part Nutmeg review, I’ll discuss my experiences with the investment platform and what my experiment was about.

A disclaimer about this Nutmeg review

Nutmeg is currently owned by JP Morgan Chase.

Like any other investment platform, there’s no guarantee of return.

In fact, you could lose all your money. Case in point, at one point in 2021, the value of my portfolio was worth less than what I had put in.

So you should only invest what you can afford to lose, and invest with a long term goal in mind.

There are no hard and fast rules around timings but it usually means at least five years, and ideally longer than 10.

My current goal is to look at returns in around five years, because I anticipate that I’ll need the money then to pay off my mortgage, which of course affects my approach to investing.

Why I went with Nutmeg

When I first joined Nutmeg in April 2020, I had a stocks and shares (S&S) ISA on a Fully Managed plan.

I had been thinking about getting into investing for some time and, when the markets crashed because of coronavirus, it seemed like the perfect time to dip my toes.

I had money to invest for the first time and, I felt, the markets could only go up.

There were lots of investment platforms to choose from, but Nutmeg appealed to me for a couple of reasons.

The first was that they actively managed your portfolio (on the Fully Managed plan) for a relatively low fee.

It’s worth noting though that there are cheaper investment platforms around, so do your research if your primary consideration is to minimise fees.

The Fully Managed plan means I don’t need to do any additional research and can effectively just set it and forget it.

For someone who’s perennially short on time, this was the perfect solution.

Another thing that swayed me was Nutmeg’s super slick app, which made navigating and comparing different options super easy and I could connect it directly to my banking app to make deposits or set up direct debits.

It’s a small thing, but it vastly improves the user experience and saves me the hassle of trying to navigate a clunky website.

Oh, and of course, when I signed up there was cashback available through Quidco* (I got £110 for my efforts).

How safe is Nutmeg?

There are inherent risks with investing of course but perhaps even more so with Nutmeg.

As a fintech startup launched in 2012, Nutmeg is a challenger to more traditional investment platforms.

It uses tech to help reduce human intervention, which in turn helps it to keep its fees low – hence why it’s often referred to as a robo-adviser.

But after more than a decade in the business, it has yet to make a profit.

I’m naturally more risk averse when there are lots of unknowns.

One helpful factor made all the difference: if Nutmeg went bust, your investments would be protected by the Financial Services Compensation Scheme up to a value of £85,000, just like in a savings account.

So in that respect, my investment was safe – even if its value could fluctuate.

My early experience with Nutmeg

I was really lucky with the timing of my early investments.

Markets had crashed globally in March 2020 so the prices for everything from shares to funds were super low.

But as economies began to recover, they shot up, taking the value of my portfolio with it.

In a relatively short amount of time, I managed to make the equivalent of a couple of years’ worth of interest, and I was soon wondering why I hadn’t started investing earlier.

I enjoyed my experience with Nutmeg so much, I opened an S&S Lifetime ISA with them as well.

But then a change in my personal circumstances meant I had to close both accounts just a few months later.

It’s the least advisable way to invest – I could have lost a lot of money – but because of the timing, I had actually made a tidy profit.

Nutmeg made opening and closing my accounts so easy – although there is a long delay when you deposit and withdraw your money – I didn’t hesitate to go back to them when I could again.

And over time, I came to love two particular features about Nutmeg.

Nutmeg’s risk assessment

Nutmeg gives you a huge number of options when it comes to risk – something that was lacking in PensionBee’s product offering for me.

When you sign up, they get you to fill in a quick quiz to help determine what’s likely to be a good level of risk for you.

Then each year, they get you to fill out the quiz again to see whether your approach to risk has changed.

In my case, the plan they suggested was actually a lower risk one than what I had wanted and ultimately went for, so you can override their suggestion.

Nutmeg investment pots

Another great feature is that Nutmeg allows you to open different pots within the same “wrapper”, in this case my S&S ISA.

Basically all of the pots contribute towards the same annual ISA allowance, but you can set a different risk profile or even investment approach for each one.

This means you can easily diversify and tailor your portfolio to suit you – for example, by adjusting investment strategies according to how long you intend to invest – or experiment, as I decided to do.

Nutmeg fees for investments

Nutmeg’s fees for the Fully Managed plan are pretty reasonable for an actively managed portfolio.

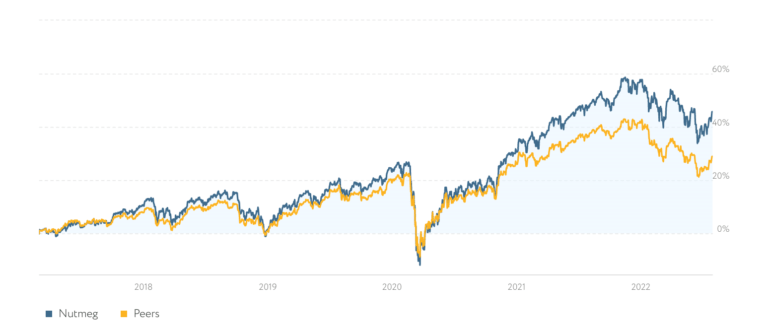

But at some point, I had begun to wonder whether or not I could achieve the same sort of returns from their Fixed Allocation plan, which is much cheaper.

For comparison, Nutmeg currently charges:

| Fully Managed | Fixed Allocation | |

| Nutmeg fees | 0.75% up to £100k 0.35% on portion beyond | 0.45% up to £100k 0.25% on portion beyond |

| Fund costs | 0.20% | 0.20% |

| Market spread | 0.03% | 0.03% |

Nutmeg fees are the fees that they charge to manage your portfolio.

They buy a mix of funds, shares and other assets for you and the fees associated with these are split across fund costs and market spread.

Based on Nutmeg’s own estimates for 2024, on a £1,000 investment, you’d expect to pay £9.80 a year in fees for Fully Managed plans, and £6.80 a year on Fixed Allocation plans.

These fees are actually slightly lower than when I last looked at them in 2022. At the time, on a £1,000 investment, you’d expect to pay £10.20 a year in fees for Fully Managed plans, and £7.10 a year on Fixed Allocation plans.

The difference isn’t huge when your portfolio is small, but as it grows, it’ll quickly stack up.

With long term planning in mind, I wanted to see whether I could save on costs while still retaining good returns, so I decided to set up an experiment.

Head this way for part two of this Nutmeg investment review.

This post was originally published in August 2022. It was updated in July 2024.

Pin this for later