Your investments are never 100% safe

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

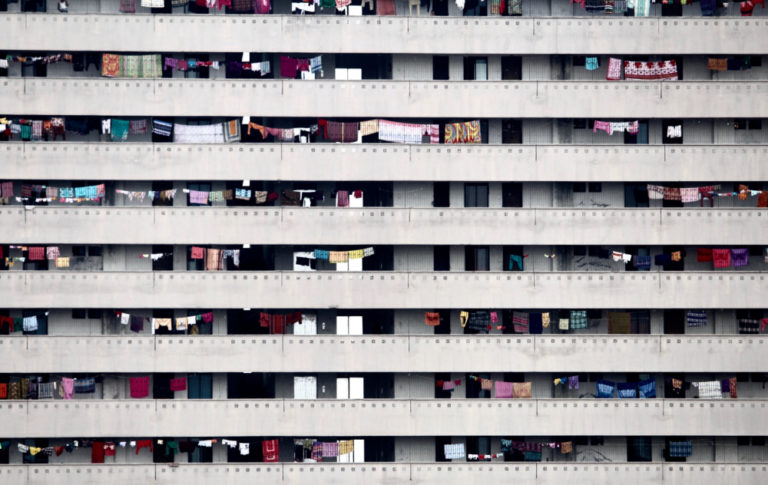

I read an interesting story in The Guardian this weekend about German Property Group (GPG), a property developer that entered preliminary bankruptcy proceedings in October 2020.

Although it’s based in Germany, the company, which was also variously known as Dolphin Capital/Dolphin Trust/Red Rock, had a substantial number of UK investors.

According to The Guardian report, one investor said she was told by her financial adviser at the time that her investment was “as safe as houses”.

It raises an interesting point.

In every type of investing, there’s an element of risk – you could win big, or lose it all. And most investment platforms will make it clear that past performance is not an indication of future returns.

When it comes to property investing specifically, we often think of it as a safe bet because in the long run, prices have trended up.

But there have also been instances where property prices have collapsed, like after the 2008/2009 financial crisis for example, when house prices dropped 15.9% according to Nationwide’s House Price Index at the time.

It took several years for property prices to recover after that, and recovery rates varied significantly across the country.

The risks increase even more when you’re investing in a specific firm rather than a whole industry.

As we have seen in this pandemic and many times before, even the biggest firms and household names are not safe from financial ruin.

What it means for you…

Obviously I can’t comment on what happened between the investor and financial adviser in question, but it is a timely reminder about investing in general.

Investments are never 100% safe, so be ready to lose some or all of the money you put in.

That means being prudent about how much of your wealth you’re investing as well as finding a percentage that works for you.

It also means spreading your risk by putting your investments in a few different places.

I speak from experience as my own investments have plummeted.

Investment firms operating in the UK have to be authorised and regulated by the Financial Conduct Authority, which gives investors a certain level of protection.

In the first instance, it means the firm has to meet certain minimum standards.

But it also means that should anything go wrong, under some circumstances investors can make a complaint to the Financial Ombudsman Service.

This might cover negligence on the part of the investment firm for example, but not if your investments fail because of the recession.

If the platform you’re using for investing fails, you may also be able to get some of your money back through the Financial Services Compensation Scheme (FSCS) – but only up to £120,000 per person, per firm.

So if you’re lucky enough to have more than that invested, it’s worth spreading the risk by diluting your investment across several different platforms.