Should you be worried about the GDP nosedive?

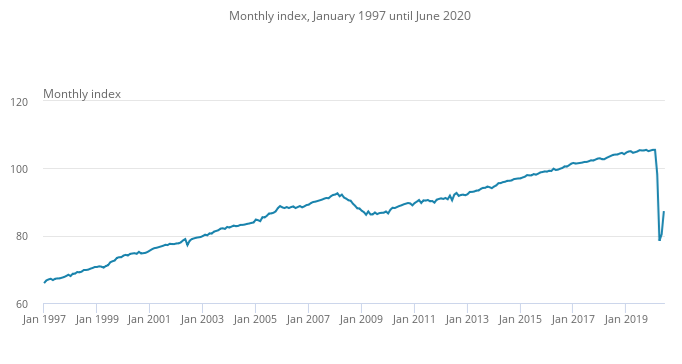

It’s impossible to miss the headlines this week: the UK’s GDP fell by a historic 20.4% in the second quarter of this year and we’re officially in the biggest recession on record.

Those are big attention-grabbing headlines, and of course there’s cause for concern, but should you really be that worried?

I posit no. And here’s why.

First, we reached the bottom in April.

You may remember how GDP figures made similar record-breaking headlines back in June.

The Office for National Statistics (ONS) had just released the figures for April and the monthly GDP figures fell by 20.4%. It dragged the quarterly figure (from February to April) down to 10.4%.

I wrote then that April was looking particularly glum because of the lockdown – many sectors of the economy were forced to shut down – and predicted that we would see it in May and June’s GDP numbers.

Indeed, when July rolled around and May’s GDP figures were released, we saw a slight increase of 1.8% in the monthly GDP figures. But, clearly, it’s still far below pre-Covid levels which means the quarterly GDP was dragged down to 19.1% (March to May).

Now, when you look at June’s monthly GDP figure, it’s actually gone up by 8.7% – a significant increase. We are now above the monthly GDP figure for January 2010, the start of the recovery from the last recession.

The quarterly GDP figure (April to June) continues to be low of course, because life had basically stalled for two months out of the three.

Second, there are good indicators of growth all round.

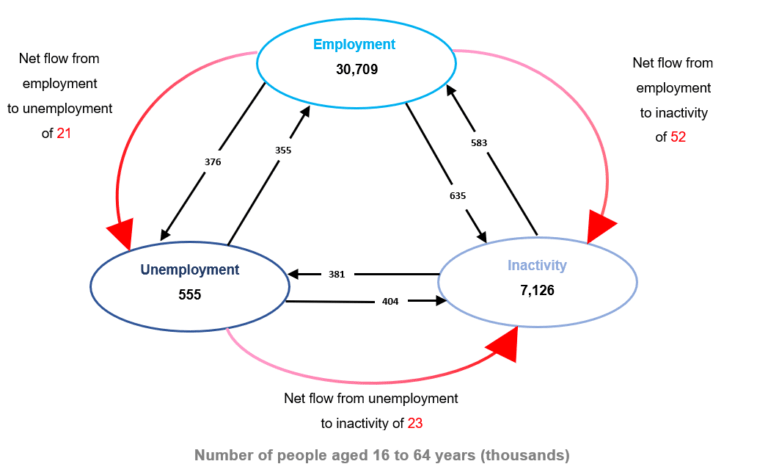

Retail sales, for example, has seen significant growth in June after the lockdown eased. And early indicators from the likes of Barclaycard show the recovery is even better in July. The number of people working is still low, but the number of jobs available has gone up (more in the second story below). Finally, we see it in the apparent boom of the housing market.

Of course, monthly GDP levels haven’t returned to pre-Covid levels – but then life hasn’t returned to pre-Covid levels either.

As for the recession, well a recession is technically defined as two consecutive quarters of falling GDP. If we continue on this upward trajectory, we may be out of the technical recession sooner than you might think.

What it means for you…

The UK economy is recovering. I’m not saying it’s going to be fast – it’s going to take time, and a lot of people will struggle during that time, but people are also resilient. I think it will be a sharp V-shaped recovery for the summer months and then the recovery rate will slow when we get to autumn.

The exception to this scenario, however, is if there’s a massive second wave and we have to go into full lockdown again.

The use of local lockdowns makes it clear that the government doesn’t want to return to a full lockdown. And they’ve become much more aggressive in tackling coronavirus in the last couple of months, compared to when the pandemic first reached our shores, so I think it’s unlikely a full lockdown will return – though of course not impossible.

If you’ve already made preparations – have an emergency fund, got your CV sorted, brushed up on your skills etc – then just live your life like you normally would. If anything, that will help you and the economy more than just worrying about it.