The mini-budget’s winners and losers

I’m sure you’ve seen the headlines. Here, I’m going to delve a little deeper into what it could mean for you.

A plan for jobs

Tens of thousands of jobs cuts were announced in the first two weeks of July so it’s reassuring to see the mini-budget has been designed to stimulate the jobs market.

Up to £30 billion has been promised as part of this plan, which will be divided between four pillars: the job retention bonus, supporting jobs, protecting jobs and creating jobs.

On paper, the bulk of the spending will be going towards the job retention bonus and creating jobs. But is it all it seems?

Job retention bonus

Up to £9.4 billion has been promised as part of the job retention bonus. This is awarded to employers who bring back furloughed workers and keep them in employment until the end of January 2021.

The 9.4 million workers currently on furlough are worth £1,000 each to businesses who bring them back.

The government expects the actual amount spent to be less than the headline figure of £9.4 billion – not all jobs will be saved and not all employers will qualify.

Critics have questioned whether it’s a waste of money to reward employers who would be bringing back their workers anyway.

That may be, but I think it can protect jobs at danger from those “trim the fat” cuts I wrote about last week. Some people (myself included) may even see their work contracts extended so employers can take advantage of that bonus.

It’s worth remembering that the dates also cover Brexit, another trigger point for businesses looking to lean up.

Still, for many it means a return to the wild west from February 2021 so those who had their jobs saved this time will have to think about what happens then.

Supporting jobs

The Kickstart Scheme and various initiatives for boosting job search, skills and apprenticeships for young people have all been grouped into the supporting jobs category, with up to £3.7 billion being allocated.

The £2 billion Kickstart Scheme will create 6-month paid work placements for “those aged 16-24 who are on Universal Credit and are deemed to be at risk of long-term unemployment”.

The government will cover 100% of the national minimum wage, national insurance and minimum pension contributions from employers. Basically, firms will get free labour for six months and those on the scheme will get much-needed work experience.

In addition to the flagship scheme, there are 10 smaller initiatives designed to reward businesses for offering training or work experience to young people and provide greater support and coaching for those looking for work.

There’s definitely a concerted effort to get more people into jobs. For example, the Work and Health Programme, which is geared towards those in vulnerable positions – including the homeless, people dependent on drugs and victims of domestic violence – will receive up to £95 million this year.

This will benefit those who are actively looking for jobs as there are potentially more opportunities and advice on how to access them.

There are obvious challenges though, like whether there are enough jobs to begin with. For those who are training or are in apprenticeships, there’s also the issue of whether there are jobs they can progress into once the scheme ends.

A lot of it will likely depend on individual initiative, too.

Protecting jobs

Under the protecting jobs umbrella, we have the VAT cut and the Eat Out to Help Out scheme, which together are worth £4.6 billion.

The hospitality sector has been among the hardest hit by the lockdown and these initiatives are designed to reverse some of the damaging effects.

Memes aside, the Eat Out to Help Out scheme (only in August) and the VAT cut (until 12 January 2021) will actually significantly lower the cost of a meal out and boost income for the industry.

The Eat Out to Help Out scheme gives 50% off a meal or non-alcoholic drink enjoyed on the premises, up to £10, which in effect doubles the spending power of many consumers. It’s a real incentive to spend at a time when everyone is cautious.

And people are still incredibly cautious despite the ease in lockdown restrictions.

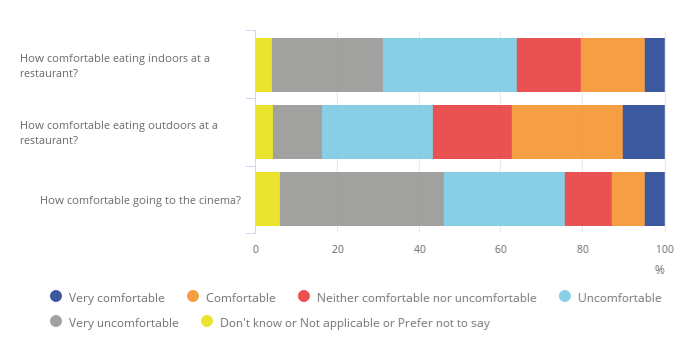

A survey conducted by the Office for National Statistics (ONS) revealed that just 20% of people are comfortable eating indoors, compared to 60% who said they were uncomfortable. It’s slightly better for dining outdoors – 37% comfortable vs 39% uncomfortable.

And the latest results from Coffer Peach Business Tracker reveal that during the super weekend we just had (4 and 5 July), total drinks sales were down 49% for Saturday and 52% for Sunday.

Aside from the foot traffic boost, food businesses could also enjoy an earnings boost if they don’t pass on the VAT savings to customers. Given some businesses are already applying a coronavirus levy to their fee, it seems unlikely consumers will see this saving.

How much of an income boost will depend on how much consumers spend, of course. At 20% VAT, businesses get just £8.33 of every £10 spent, but at 5% VAT, businesses will receive £9.52.

The VAT cut also applies to accommodation and attractions, which are more likely to pass on some of the savings to stay competitive. It’s especially important right now because, according to the aforementioned ONS survey, only 25% of adults said they are thinking about going on holiday in the UK this summer and just 9% are considering a holiday abroad.

The VAT cut will kick in from 15 July but the Eat Out to Help Out scheme won’t come into effect until August. A lot can happen between now and then but if there are no big coronavirus spikes, people will start going out again. That in turn means more businesses reopening as the furlough scheme tapers off, giving more people a better chance of holding on to their jobs.

The downside? When VAT reverts in January, people may be surprised by the sudden price surge just after Brexit.

Creating jobs

Finally, four initiatives are being used to stimulate job creation: an infrastructure package, public sector and social housing decarbonisation scheme, the Green Homes Grant and a temporary reduction of the Stamp Duty Land Tax (SDLT).

Together, these are worth £12.5 billion, with the bulk of the sum being allocated to the infrastructure package and the SDLT cut.

This is the most dubious section of the plan because it’s not clear at first or even second glance how much of it is new money and how much of it has been repackaged.

For example, the £5.6 billion allocated to the broad category of “infrastructure package” refers to that “Build, Build, Build” speech Boris Johnson made on 30 June.

It’s been wrapped into this jobs announcement because the construction industry employs 2.3 million workers, including 900,000 self-employed ones. But how many jobs will be created versus how many will just be protected remains to be seen.

If you paid attention to the budget in March 2020, you might also remember many of the green initiatives mentioned this time round, including the decarbonisation of just about everything.

The biggest change, therefore, is the temporary reduction of SDLT, which is applicable now until 31 March 2021. Given the recent slump in the housing market, this sounds like a great way to kickstart the system – even for some first-time buyers.

As I mentioned in previous weeks, the availability of mortgages has dropped significantly since the pandemic and first-time buyers are also having to stump up a bigger deposit. The savings on stamp duty may just give them the extra help they need to get on the ladder.

I’m not sure it will create many new jobs though, but at least it can help maintain some of the existing ones.

Who’s losing out

Obviously the Chancellor is limited in what he can do but there are some clear losers.

At the moment, there’s no clear support for freelance workers. With the exception of perhaps the housing sector, many of the stimulus in place are geared towards businesses rather than individuals.

Theoretically, if the economy picks up enough, there will be a steady trickle of jobs going to non-PAYE workers. But the reality is that in the short term, things will be incredibly tough.

Part-time workers who have been put on furlough will also likely struggle to get their jobs back as employers will only qualify for the job retention bonus if the employee earned an average of at least £520 per month.

And given that part-time workers will likely already be in industries heavily affected by the pandemic, their bad luck will likely continue.

Finally, first-time buyers who don’t get on the ladder this time probably won’t benefit from the stamp duty cut in the long run.

The SDLT cut applies to all homeowners, including those who have multiple homes – they are the ones set to make the biggest savings. But if house prices are kept high, and the lack of mortgage availability continues, fewer first-time buyers will be able to get onto the ladder in the long run.