How to start investing

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

Getting into investing can seem like a daunting prospect.

After all, there are so many warnings about losing all your money. And this is very much true.

As every investment product will tell you, investing involves an element of risk. You may end up with less money than you put in.

Plus, past performance is not an indicator of future returns. Essentially, you should only invest what you can afford to lose.

But investing can also bring in big returns if you know what you’re doing.

With that in mind, I asked Hannah Owen, a financial planner at Quilter, for some insights on how to start investing as a beginner.

What’s the first step to investing?

According to Owen, the first step is choosing a “wrapper” (the type of product) to hold your investment in. There are lots of options for this but the two most obvious choices are stocks and shares ISAs or a pension.

The stocks and shares ISA allowance is £20,000 a year (shared with a LISA), while for pensions it’s up to £60,000 a year.

For both of these, there are pros and cons.

Owen said: “You can open a stocks and shares ISA, meaning that any growth will be tax free. If you are looking to hold an investment, this may be a suitable place to start.

“A pension will give you tax relief, which is money that the government adds to your contribution. Opening a pension will really help in retirement, however you cannot access it until you are 55, rising to 57 in 2028.”

How do you choose the right product? What are some of the low risk options?

Choosing the most suitable investment product will depend on a number of factors, including how long you’re planning to invest, what your goals are and your appetite for risk.

Owen suggests that investing novices start with a fund.

She explained: “For a novice, you should look towards a fund, whereby your money is pooled with others and invested together.

“You can choose your fund based on how much risk you are willing to take, and how much risk you can afford to take. Generally, if you are investing for a longer term and are less reliant on the funds for a certain goal, the more risk you can afford to take.

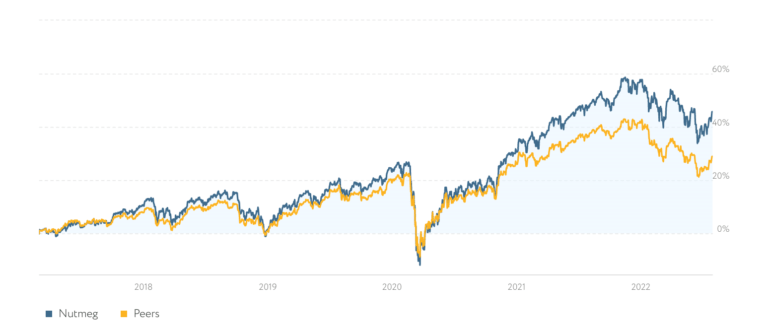

“Tracker funds usually come in at a lower cost – they are broadly set up to track an index.

“Active funds are often more expensive, but have a manager who will research the market, and actively make decisions with the underlying monies.”

Is there a minimum/maximum amount you should invest? And how long should you invest?

How long you’re planning to invest for, what your goals are and your appetite for risk will all inform how long you invest, and the minimum/maximum amount you might want to put in.

Owen suggested an investment period of at least five years. That means it’s money you don’t need to use for the next five years and can afford to lose if investments go bad. If you’re investing for a shorter period, you might want to pick a lower risk option.

As for how much to invest, Owen said: “Some wrappers have maximum investment amounts. ISAs are £20,000 each tax year, whilst the amount you can put into a pension varies depending on your circumstances, such as how much you earn in the tax year.”

Obviously if you’re just starting, you might not want to invest all your money without speaking to a financial adviser first.

What are some of the unexpected costs?

Unlike savings, investments come with “running costs” that you’ll have to pay even if your investment makes a loss.

“In terms of cost, you will generally have a few charges associated with your investment, such as the platform and fund costs, which are usually charged as a percentage of your overall investment,” Owen explained.

She added: “Unless platforms have a minimum fee in place, the percentage structure of investment fees mean that you should not be deterred that the amount you have to invest is too small.

“Platform costs vary from platform to platform, so it is wise to shop around. Many platforms offer a tiered charging structure, meaning that the more that you hold, the lower the overall percentage charges.

What are some of the pitfalls to consider? And what red flags should you look out for?

Before you invest, Owen suggests checking on the financial services register to see whether the platform you’re using is legitimate and regulated.

After that, it’s all about spreading your risk and not moving your money around too much.

Owen said: “You should consider widely diversifying where your money is held, to garner a strong return relative to risk, ensure that you are invested in various assets across the globe.

“It is also important not to shift your investment around too much. Investment is for the long term and that is the best way to make the most of your money. Markets will rise and fall but over an extended period of time you will make money.”

Read more: Hargreaves Lansdown review: Investing as a beginner

When should you cash out?

For Owen, it’s time to cash out when “you know what you are doing next with your money”. Otherwise just keep it there and let it grow.

She added: “The most important point is do not cash out just because markets are low or dropping. It’s hard to see your money go down but it’s important to remember and trust your investment plan.

This post was originally published in October 2020. It was updated in July 2024.

Pin this for later