Money Rules: Diversify in investing

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

I often wish I had started investing earlier.

It’s not that I had a lot of spare cash to invest, but I could have done so much more with what I did have.

The disclaimer – that I could get back less than I put in – was off-putting. But I also didn’t put as much effort into learning about the different investment options that were open to me.

That’s changed of course, but I still feel like I’m catching up.

So for this Money Rules post, I was keen to hear from someone who has been investing for a while.

It comes from Nick Daws, who writes Pounds and Sense, a personal finance blog aimed at over-50s that covers making money, saving money and investing from an older person’s perspective.

Daws’ money rule is to diversify in investing.

When did you start this rule and why?

I learned this rule from my dad, though unfortunately it was through his mistake.

Dad was a lovely man and I learned many important life skills from him – but sadly money was never his strong point.

About 30 years ago, a distant relative persuaded him to invest all his savings in a media services business a friend of a friend was setting up.

I didn’t hear about this until after the investment had been made.

Even though I was a lot younger then, I could still see it was insanely risky.

It was a new business with no track record. And dad knew nothing at all about the media – he was a carpet-fitter turned hydraulic machinery salesman. And perhaps sensing that his wife would disapprove, he didn’t actually bother to tell her about it.

For the next year or so, any time my partner and I went to visit, dad would find an opportunity to take us aside to give us an update. Inevitably this would begin with a conspiratorial, “Don’t tell Shirley [my stepmother], but…”

At first, the news seemed positive. But it soon became clear the business was going down the drain and dad’s money with it.

I’ll never know the full story, but in my view he was badly advised (to put it kindly) by the relative concerned and quite probably cheated by the main shareholder, though it was all technically within the law.

Eventually he had to confess to my stepmother that he had lost their life’s savings. This inevitably caused a rift between them and had further ramifications that continued for the rest of their lives.

This entire incident was, of course, deeply traumatic for the whole family. The one good thing it taught me was the folly of putting all your eggs in one basket when investing.

I vowed I would never make that mistake with my own investments and have always aimed to diversify as widely as possible. To date, that principle has served me well.

Why is this your number one money rule?

In my view, diversification is the key to successful investing.

To be clear, I am a fan of investing. In the long term it has the potential to deliver significantly better returns than putting your money in a cash savings account. But there are never any guarantees, and there is always a risk of losing money if any particular investment under-performs.

By having a broad range of investments, you’ll hopefully ensure that even if one or two do poorly, others will perform well, and you will still enjoy a good overall return.

At the very least, having a well-diversified portfolio should ensure that you don’t lose all your money as my dad sadly did.

How does the rule work in practice?

There is no one single recipe for successfully diversifying your investments, but here are some principles I’ve tried to follow myself:

- Don’t even think about investing until you have paid off any interest-charging debts. You should also have at least three months’ worth of income in an accessible form, such as an easy-access savings account, in case of unexpected emergencies.

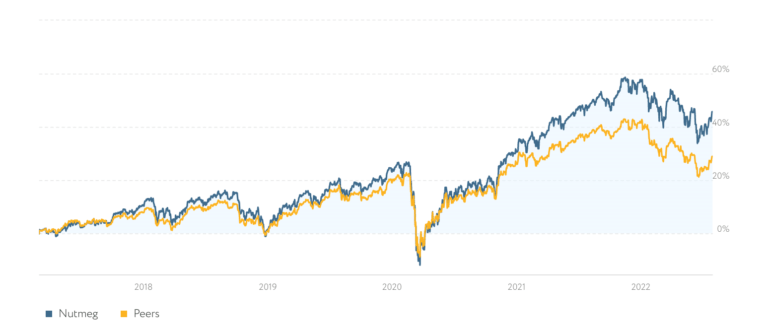

- Don’t invest more than a small proportion of your portfolio in single company shares. You will get much better diversification by opting instead for an investment fund, ETF (exchange-traded fund) or investment trust, all of which work roughly the same way and invest your cash across a broad range of assets.

- Aim to invest not only in different companies but in different countries and regions, market sectors, investment platforms and asset classes (shares, bonds, property, commodities, etc.). A well-diversified global fund can be a good starting point.

- Make good use of your annual tax-free ISA allowance. This is currently a generous £20,000 a year. Investing via a reputable stocks and shares ISA can save you thousands of pounds in tax.

With a well-diversified portfolio, you greatly improve the chances that if one or more of your investments fails to perform to expectations, others will compensate.

And whatever happens in the world, your overall investment pot will hopefully build over time into a substantial sum.

How has it helped you manage your money?

The rule has helped me build my savings and pension pots over the years, through good times and bad, economically speaking. I am now semi-retired and living off a combination of the state pension, my SIPP (self-invested personal pension), and various other investments.

I wouldn’t say I was wealthy, but I have enough coming in to pay the bills and enjoy later life to the full.

Very importantly, following this rule has also prevented me from putting large sums of money into high-risk investments only to have them sink without trace.

It hasn’t stopped me from making the odd mistake though.

For example, I invested too much money in property crowdfunding a few years ago and got my fingers burned. But at least following my rule protected me from disastrous losses.

Are there any downsides?

Occasionally I’ve wished I put more money into a particular investment after it has performed exceptionally well. Tesla shares would be one example. But I try to be philosophical about this and remind myself I am still making good returns overall without risking losing my shirt.

Finally, do you have any other hints and tips?

Again, very much based on my dad’s example, I would suggest that you avoid investing in things you don’t understand.

Personally I put cryptocurrencies in that category.

Okay, if I had a time machine I would go back 10 years and buy as much Bitcoin as possible. But who wouldn’t?

In real life, crypto is just too risky for me. I much prefer to invest in businesses where I have some understanding of what is going on day to day and how the profits are being generated.

Pin this for later