Money Rules: Track all your spending

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

Do you know how much you’re spending every month? And on what?

I dare say that most of us don’t.

It’s not a problem per se, except for when you’re trying to budget or cut back – or indeed, seeing your spending spiral out of control and into problem debt.

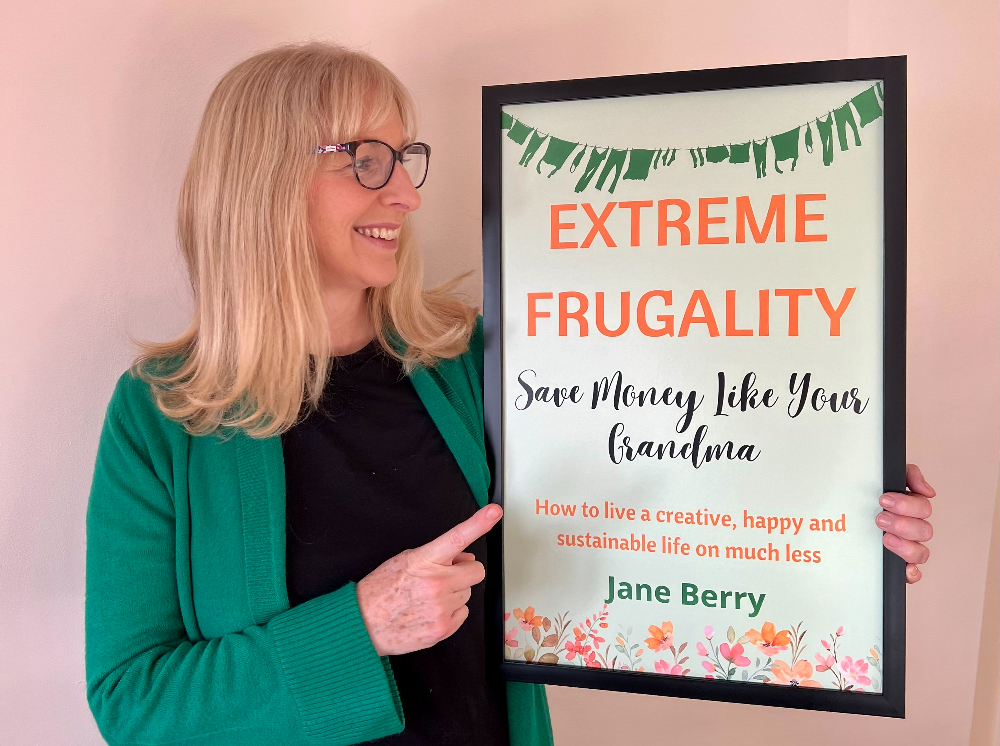

For Jane Berry, author of Extreme Frugality: Save Money Like Your Grandma* and award-winning blog, Shoestring Cottage, the best way to manage your finances is to track all your spending.

Here, she explains how the rule has helped her to get in control of her finances in the last decade.

When did you start this rule and why?

I began this rule around 2009, early in my journey towards a more frugal life. I had recently separated from my then husband and was facing a much-reduced income.

I honestly didn’t know what went in and out of our bank account during our marriage; we seemed to muddle along OK with two incomes.

However, I continued with some of my bad financial habits when I became newly single. I knew I had to learn to live on less, but it took a while to get myself organised.

Low level debt and a constant overdraft began to give me a gnawing sense of anxiety and sleepless nights, and I knew I had to get a grip.

Why is this your number one money rule?

Once I had made the decision to take my finances in hand, I knew that tracking my spending would give me a clear picture of where my money was going and where I could cut back.

It was the frequent small cash withdrawals – in the days before you could pay for everything with a debit card or your smart phone – that were messing up my budget.

When you don’t have a lot of spare cash, buying sweets and toys for the kids, grabbing take-away food and ready meals, indulging in lots of expensive glossy magazines, books and music, and treating yourself to bottles of wine and snacks on a regular basis can soon add up to a considerable amount, as I quickly discovered.

How does the rule work in practice?

The way I tracked my spending when I started all those years ago was to keep a small notebook and pen with me.

I got into the habit of writing down everything I bought, even when I put a pound in the charity box at work or bought a newspaper.

Seeing your spending recorded so starkly is like a dieter facing their poor eating habits.

If you are honest and write down everything you eat, you spot the extra biscuits, the half a dessert one of your children left that you didn’t want to waste, or the crisps you pick on when you are bored, etc.

Nowadays, there are easier ways to track your spending, of course. I’m old school though, so I keep paper receipts as my starting point.

Every few days, I record my spends in a section of my budget book. I then go through all of my online spending and check my account balance to make sure I haven’t forgotten anything.

How has it helped you manage your money?

Tracking my spending allows me to set a realistic budget each month, and having a written budget is another one of my money rules.

It’s very difficult to set a budget for these things if you have no idea how much you generally spend, so I record my regular income and outgoings, and set target amounts for variables such as food, fuel, clothing, entertainment, etc.

I keep an eye on my spending as the month progresses to see if I have to rein it in for specific categories. If I’ve spent too much on, say, clothing, I’ll need to reduce the amount I spend elsewhere.

Are there any downsides?

Of course, budgeting and tracking your spending is a chore.

However, if you have debts or are not managing to get to the end of the month without running out of money, regaining a sense of control is both reassuring and satisfying.

Finally, do you have any other hints and tips?

Something that works for me is to have a physical budget book, with a section to track daily spending, and to keep it where I can’t avoid seeing it.

Mine lives on the coffee table. This helps me to remember to add my expenditures and check my budget regularly.

However, you may find a method that works better for you. The main thing is not to stick your head in the sand.

It can also help to have a goal. For example, yours might be a specific savings goal or to pay off debt. Tracking your spending and then reducing it could help you to achieve these financial goals.