Index fund explained: A beginner’s guide to passive investing

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

Index funds are one of the easiest ways to get into investing.

As a financial product, they’re relatively simple to understand, are low cost and have good potential for growth – though of course returns are never certain in investing.

They’re also low maintenance, especially compared to investing in stocks and shares.

But while they can be great for more passive investing, you definitely shouldn’t just set it and forget it – here’s why.

What are index funds?

An index fund is a pooled pot of money that’s invested in a range of different assets, typically shares or bonds.

What makes it unique is that the investments mirror a particular index, for example the FTSE 100.

It does this by investing a percentage of the fund in each of the entities tracked by the index, at the same proportion as the market share of the entity.

I use the term entity here because, depending on what the index is tracking, it could be a company’s shares or government bonds or another type of asset.

The idea is that if the index moves up because the market is performing well, the index fund will also perform well.

Similarly, if the index is falling because the market is experiencing a downturn, the index fund will also fall in value.

Why are index funds so popular?

There are a few reasons for index funds’ popularity, especially among novice investors.

Reduced risks

The adage “don’t put all of your eggs in one basket” is very much applicable to investing – and index funds allow you to diversify your investment portfolio with relative ease.

Unlike buying stocks and shares, where you’re investing in a single company, index funds invest in multiple companies, and often across multiple industries and countries.

This limits your exposure to market volatility so even if there’s a dip in one industry, you might still see gains in other sectors and even gains overall.

Lower fees

Unlike actively managed funds, where someone is making day-to-day trading decisions to maximise profits for the fund, index funds are passively managed.

So someone is still overseeing the fund, and making sure that it correctly tracks the market, but there isn’t a team actively buying and selling everyday.

This hands-off approach means fewer people are employed, and therefore lower fees overall.

And of course, lower fees means you get to keep more of your investment returns.

Better returns

Index funds track the market so the value of your investment can go up or down.

However, historically, most index funds have outperformed their actively managed counterparts.

A key contributor to this win is the fact that index funds have much lower fees as more often than not, any gains on an actively managed fund are offset by the fees they charge.

Minimal maintenance

The main benefit of index funds, for me at least, is that they require minimal maintenance compared to investing in stocks and shares.

You don’t need to actively watch the market to decide whether to buy or sell, for example.

There are also far fewer funds you need to research compared to the number of companies you could invest in individually.

Many investment platforms have off-the-peg portfolios that you can simply buy into, which will save you even more time.

Are there any downsides to index funds?

Index funds are certainly not flawless as investment products.

While active managed funds can and do beat the market in certain situations, index funds are designed to mirror it.

So during a market downturn, your index fund is guaranteed to fall in value – you just have to wait for the economy to recover if that happens – but an actively managed fund might actually make gains during this period.

Index funds also can’t pick and choose what companies to invest in – they must mirror the market.

Even if a company is overvalued, or a certain industry is becoming extremely risky, the fund cannot deviate from its set strategy to avoid a potential loss.

Your investment portfolio might also end up being less diversified than you think if the fund invests heavily in one or two companies because they dominate that market.

How do you invest in index funds?

Investing in index funds is easy, but there are a few things you should/need to do.

Choose an investment account

To start with, you’ll need to have an account with an investment platform that offers index funds.

Before you choose one, make sure you know what the fees are and what you’re getting for the fees.

There are some start up platforms with no fees or extremely low fees out there, but they might not offer a great deal of security for a larger portfolio.

Some platforms might also have dated technology – a poorly designed app, for example – that make managing your money a clunky and off-putting experience.

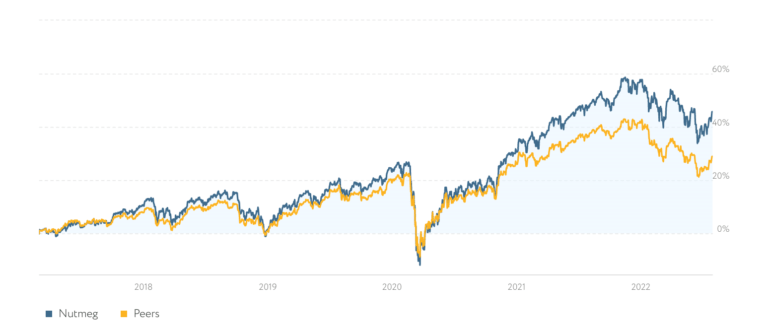

An easy to use website and app were central to why I decided to invest with Nutmeg and later Hargreaves Lansdown rather than their competitors.

It’s also worth bearing in mind that different platforms might have different index funds available, and some funds might be exclusive to one or two platforms.

Decide how much you want to invest

Once you’ve got your account open, you’ll need to deposit some money to start investing.

There’s usually a minimum investment amount, and it depends on the platform.

For a lump sum investment, the minimum is usually £100.

But if you’re committing to investing every month via standing order or direct debit then the minimum drops to around £25 a month.

Markets go up and down everyday, and can be unpredictable, which is why people say “time in the market, not timing the market”.

That effectively means investing small amounts regularly.

But when there’s a big market crash? Well, plenty of people will do a lump sum deposit while prices are low so they can take advantage of the gains when the markets improve.

Of course, working out when the upswing will happen is tricky, and you certainly shouldn’t be investing money that you think you’ll need in the near future.

Know your tax liabilities

Income from investments is liable for income tax, while any profits you make from selling your investments is liable for capital gains tax.

However, if your investment is held in an ISA or a SIPP (self-invested personal pension) account then it’s shielded from those taxes.

In the case of SIPPs, the money will be liable for income tax when you start making withdrawals – just like your personal pension or the State Pension.

Some investment platforms will hold your money in a general investment account unless you specify that it should go into an ISA – and this has happened to me before.

Money held in a general investment account will be liable for tax so it’s worth double checking your money has gone to the right place after it lands in your account.

How to choose your funds

Index funds were first created by John Bogle, the founder of investment platform Vanguard, so it’s no surprise they offer the biggest range of index funds, with over 100 to choose from.

Other investment platforms will have significantly less to choose from.

More doesn’t necessarily mean better though – it all depends on what your long term goals and strategy are.

You can find an investment adviser authorised or approved by the Financial Conduct Authority (FCA) to help with this, but you can also do the research yourself.

Obviously you want growth, and the best way to maximise your chances of success is to look for a fund with low fees and a strong track record.

All funds will have a factsheet that breaks down their past performance, though of course this does not necessarily mean they will continue the strong growth in future.

There are other things to consider too.

Geographical focus

It’s possible to pick regional and country-specific index funds.

In general, the US markets have raced ahead of other regions, but it doesn’t necessarily mean that will always be the case.

Some people consider Asia to be a strong emerging market with a good potential for growth, and therefore worth investing in if you can get in there early.

The UK and Europe have traditionally been considered sluggish, but it doesn’t mean there aren’t any winners there.

Or you might just want to go for a global fund instead, which reduces your exposure to any single region.

Industry exposure

A fund’s factsheet will have details of the companies and industries it invests in, say technology or pharmaceuticals.

If you want a diversified portfolio, and are picking multiple index funds, it’s important to look at this section because sometimes the top 10 companies or industries are the same in different funds.

So even though you think you’re diversifying by buying more than one index fund, what you might actually be doing is buying funds that invest in the same companies or industries but in slightly different proportions.

Ethical considerations

If you want to avoid investing in oil companies or certain industries, ESG (Environmental, Social, and Governance) funds are a good starting point.

But it’s worth bearing in mind that ESG funds can be more risky, and prone to volatility without promise of returns.

You also don’t have a choice when it comes to what companies you invest in within the ESG bracket, so might still end up investing in a company you want to boycott.

Final thing – don’t set it and forget it

Although index funds are ideal for passive investing, you shouldn’t set it and forget it.

The companies and industries your funds invest in will change, which can make your portfolio less diversified over time.

Your risk profile might have changed over time too, so another index fund might be more suitable.

And sometimes, for whatever reason, your fund might go through long periods of under-performance, so you may want to switch to an alternative.

Pin this for later