PensionBee review: How transferring your pension works

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

This is the second of my three-part PensionBee review.

Part one was all about why I picked them for my self employed pension.

Part two will focus on how transferring a pension into PensionBee and making direct deposits actually work, as well as my experience with the processes.

And in part three, I discuss how my pension performed.

A disclaimer before we start

As before, this review is my experience and personal opinion only and shouldn’t constitute any sort of financial advice.

For that, you would need to go to someone who’s regulated by the Financial Conduct Authority, who can tailor their advice to your situation.

How to open a PensionBee account

Opening a PensionBee account is really straightforward and pretty much works in the same way as it does when you open a bank account.

You just need to go to their website, click “Get Started”, and then follow the instructions.

As for transferring in your pension, they’ve also made that super easy – in theory at least.

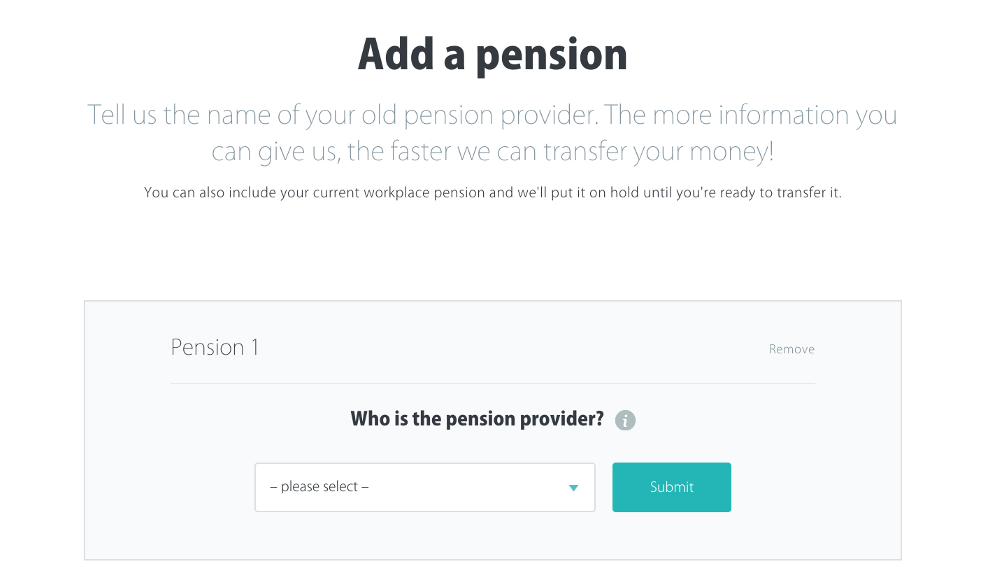

There are just three boxes to fill in.

In the first box you choose your pension provider from a dropdown list, then in the second box you can add in your policy number.

Adding your policy number is optional; it just helps to speed up the process and you can always add it later on, alongside how much you think your pension is currently worth.

In the final box, you select whether your current employer is still paying into the pension you want to transfer, and then hit submit.

All of the pensions you’ve submitted will appear on a “Transfers” tab of your dashboard when you log in.

This is where you can fill in any additional details to help speed up the transfer, or just check the progress of the transfer.

You can also request a pension transfer via PensionBee’s app in the same way.

Transferring my pensions into PensionBee

I opened my PensionBee account at the beginning of July 2021 and requested to have four different portfolios transferred in from three different providers.

Because I had been thinking about merging my pensions for a while, I had all of their details to hand.

Within a week, I was contacted by my personal “BeeKeeper” to update me on the progress of the transfers. So far, so good.

And by the end of that month, the first of my pensions had been transferred in and invested.

But the honeymoon phase was ending fast.

A pension transfer hiccup…

On the day my BeeKeeper emailed me, I had actually already emailed them – I spotted that one of the portfolios I wanted to transfer kept being deleted off the system.

I had two pensions with the same provider, from different former employers, which apparently confused the PensionBee system.

This is despite the fact that I had entered different policy numbers and amounts for them.

My BeeKeeper quickly sorted out the confusion and, within a week, told me that both pensions had benefits attached to them.

I decided to leave them where they were for the time being and the transfer requests were closed.

… followed by another pension transfer hiccup

The final pension transfer was in a holding pattern.

PensionBee specified on their website that the process can take anywhere between a couple of weeks to a couple of months, so I sort of forgot about it.

By December 2021, I was still waiting for this pension to be transferred in.

Having received a portfolio update from my previous provider, I was nudged into contacting PensionBee.

My new BeeKeeper responded straightaway and promised to follow up. A delay was possible though because of Christmas. Fair enough.

More bad news

In January 2022, I heard back, and it was bad news.

Apparently my original pension provider had sent the requested documents to PensionBee by post rather than email for security reasons but, “unfortunately this was never received by PensionBee, so no action has been taken”.

Covid pandemic notwithstanding, I was shocked to learn that not only was my pension information out there somewhere, but that apparently no effort had been made to follow up.

Worse – the deadline for the transfer was in 10 days’ time (six months from when the original transfer request was made), and if we missed it we’d have to wait until July before making another request, or pay a fee.

My BeeKeeper told me via email: “We may, however, still be able to progress the transfer before the deadline. I’ve asked for them to re-send the information, which they will do, but the chances of this arriving in time are slim as they insist on posting information to us.

“Instead – may you contact them, as they would be prepared to email you the information that we’d requested, and then you could forward the information to us more quickly by email (they won’t email us directly for some reason).”

This was not quite what I had anticipated from a pension provider designed to make transfers easy.

The request PensionBee wanted me to make on their behalf was for an off-puttingly long and specific list of items, and I was pretty busy.

Plus, the financial markets had already been volatile for a couple of months so it wasn’t exactly an opportune time to consider a transfer.

But then the paperwork arrived two days later, and the transfer process started and finished before the deadline.

Transferring my pension out of PensionBee

It didn’t take me long to give up hope on PensionBee because of my portfolio’s poor performance.

So in February 2024, at the earliest opportunity (when my portfolio returned to black), I transferred my pension out from PensionBee.

I had such a great experience with Hargreaves Lansdown that I decided to switch to them and open up a SIPP.

The process was far less painless – I just filled in one form and they handled everything.

Cashback for pension transfer

Finally, all of the pensions that I decided to transfer were in the same place – but it took six months to get it done, and only because I had followed up.

I didn’t bother complaining – although I imagine I had good cause to – and PensionBee didn’t bother to offer any apologies either. But at least the job was done.

You may remember that one of the reasons why I decided to go with PensionBee was for the cashback.

Well, after a bit of back and forth with TopCashback* (it wasn’t tracked properly because the transfers took so long), I only ended up with £26.25, which was quite a bit less than I thought I would be getting.

Obviously I transferred through a smaller amount than I thought, but it did seem a bit laughable for the effort it took in the end.

Making direct deposits into PensionBee

As well as pension transfers, PensionBee allows you to make direct contributions; you can deposit the money either via a monthly direct debit or as a one-off lump sum.

For both of these, you can set up payments via the website or their app.

The direct debit process is a bit more straightforward – you just enter your bank details and amount and then go from there.

For one-off contributions via the website, you’ll have to set up PensionBee as a payee with your bank, and then pay them through that.

If you use the app, you can make direct deposits without setting up PensionBee as a payee – as long as you also have your bank’s banking app installed.

Once you’ve entered the requested details into the PensionBee app, including the amounts and frequency, it’ll take you to your banking app where you’ll have to sign in and confirm the payment.

And when that’s all gone through, you’ll be taken back to PensionBee.

It’s a bit quicker and more straightforward, and you don’t have to worry about entering the wrong numbers.

But while most major banks allow this “digital payment overlay”, it’s not accepted across the board. You can pay by debit card as an alternative.

Once your money is in, PensionBee will claim tax relief for you. Although if you’re a higher or additional rate payer, you may have to claim this separately.

How I decided how much and when to pay into my pension

My personal preference is to make lump sum pension contributions.

As a freelancer, my monthly income fluctuates and can vary significantly throughout the year.

By making a lump sum contribution, it’s much easier to work out an amount that suits me.

As for when I make my deposit, it’s based on my financial year.

When I first registered as a freelancer in 2010, I decided to use the tax year (April 6 – April 5) as my financial year – it took out some of the hassle of doing my accounts.

This time frame means that by December each year, I can pretty much see how much I’m expected to earn in that financial year.

Then based on how much I might expect to pay in taxes, and how much money I have saved, I can decide how much money to put away.

Although I can afford to contribute more towards my pension, putting away a huge amount right now isn’t actually my top priority.

This post was originally published in August 2022. It was updated in July 2024.

The other posts in PensionBee review series

- Why I picked PensionBee for my self employed pension

- How my pension portfolio performed after a year

Pin this for later