What if the value of your pension falls?

Money Talk is intended to inform and educate; it's not financial advice. Affiliate links, including from Amazon, are used to help fund the site. If you make a purchase via a link marked with an *, Money Talk might receive a commission at no cost to you. Find out more here.

Much like investing, the value of your pension can go up or down.

You can even end up with less than you put in, especially after you factor in those management fees.

After major shifts in the market – shortly after the coronavirus pandemic started, for example, or the 2008/2009 financial crisis – the value of pensions can dramatically plummet.

While those who have more of their holdings in cash aren’t as badly affected, the same isn’t true for those holding only volatile stocks and shares.

And it will also affect people differently depending on whether they’re nearing retirement age or still early in their career.

With that in mind, I asked Matt Amesbury, head of retirement advice at Purely Pensions, for his take.

If you’re retiring soon…

Matt said: “For people approaching retirement soon, the investment market volatility created by the coronavirus crisis has meant that they could be entering later life with a pension pot worth significantly less than they previously expected.

“However, while it could be tempting to make big changes to investments, it is important to remember that making decisions about a pension investment strategy solely based on short-term events can have far-reaching consequences.

“Savers need to consider how any decisions now could impact their financial wellbeing and retirement prospects further down the line.

“Before making any major decisions, it’s important to first seek help from an expert.

“For most people, this will mean speaking with an independent financial planner.

“Working with one of these professionals is key because they can work through a person’s short, medium and long-term goals and how their pension investment strategy can underpin those aims.

“This needs to be considered because for some people, retirement will be an ever-changing journey. Their financial needs will change as they progress through later life and they’ll therefore need a financial plan that is adaptable.”

If you are in your 30s…

Matt said: “For people who still have several decades before they reach retirement age, the impact of the crisis on their pension savings should not be cause to panic.

“The basic principles of pension saving remain the same: it is a case of maximising contributions in the lead-up to later life to benefit from compounding interest and long-term fund performance.

“Those in their 30s, 40s and 50s should continue to prioritise their pension contributions and maximise the amount they pay in wherever possible.

“It is often also worth speaking with an employer about the maximum amount they are willing to match, as increasing this can significantly boost annual contributions.”

Read more: How salary sacrifice can increase your take-home pay

How much money do you need to have in your pension pot?

At this point, you may well be wondering just how much money you need to retire comfortably.

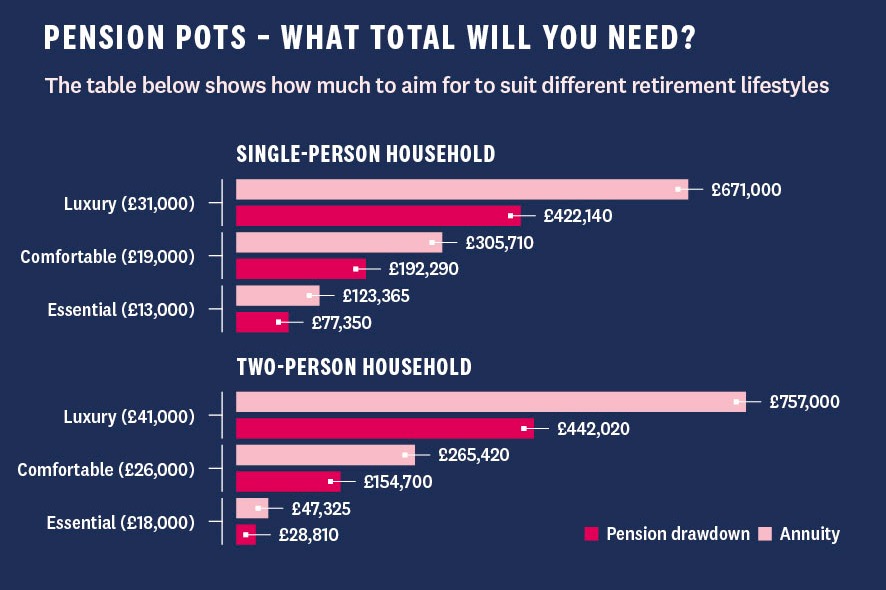

Which? Money has crunched the numbers on this for three different lifestyle scenarios: essential, comfort and luxury.

- Essential: food and drink (excluding meals out), housing payments (mortgage, rent or council tax), transport, utility bills, insurance, household goods, clothes, shoes and health products.

- Comfortable: includes the “essentials”, as well as regular short-haul holidays, recreation and leisure, tobacco, alcohol and charity giving.

- Luxury: includes both “essential” and “comfortable” spending categories, as well as extended or long-haul holidays, health club memberships, expensive meals out, and a new car every five years.

A single person would need an annual pension income of £13,000, £19,000 and £31,000 for essential, comfortable and luxury retirements respectively.

This would mean a pension pot worth at least £77,350, £192,290 or £422,140 on top of your state pension, depending on which lifestyle you chose.

A couple, who can share some of the costs and pool their resources, would need an annual pension income of £18,000, £26,000 and £41,000 for essential, comfortable and luxury retirements respectively.

This translates to a pension pot of £28,810, £154,700, or £442,020 on top of their state pension incomes depending on which lifestyle they chose.

Essentially, it’s financially prudent to be coupled up in old age and you need to save a fair bit of cash yourself if you want to relax and enjoy retirement.

How do you plan ahead to make your retirement more financially secure?

Matt said: “The first stage in effective retirement planning for most people is to consider at what point they actually plan to stop working, and whether that process will be phased.

“They also need to consider how much income they will need each year to achieve their aspirational retirement – in other words, what they picture in their head when it comes to life after work.

“A good starting point is to think about how much will be needed to cover essential expenses, as well as discretionary costs.

“Once a person is clear on just how much they need to have saved to live comfortably in retirement, then they will have an idea of how much they need to save.

“Of course, maximising contributions is a good start, but it is also really helpful to avoid carrying any existing debts into later life.

“People should aim to pay down their debts or move them to low interest options before their income becomes more fixed.”

Pin this for later